The strategic importance of global rare earth resources continues to rise, and the rare earth industry is entering a new era of high-quality development. On the supply side, quota controls combined with regulatory policies are expected to further strengthen the rigid supply logic. On the demand side, emerging sectors such as new energy vehicles, humanoid robots, and the low-altitude economy are poised to become the core drivers of long-term, high-speed demand growth. We anticipate that the global rare earth supply-demand gap may widen continuously starting in 2026, with rare earth prices expected to remain stable or trend upward. The profitability of the industry chain is likely to improve consistently, and we continue to recommend the strategic allocation value of the rare earth industry chain.

The Rare Earth Industry Enters a New Era of High-Quality Development

Since the State Council first proposed the "Rare Earth Strategic Reserve" in 2011, a series of policies aimed at protecting rare earth resources and accelerating the innovation and application of key core technologies have been introduced. In November 2023, Premier Li Qiang emphasized the promotion of high-quality development in the rare earth industry at a State Council executive meeting. In October 2024, the "Rare Earth Management Regulations" were officially implemented. In August 2025, the "Interim Measures for the Total Control of Rare Earth Mining and Rare Earth Smelting Separation" were issued. National policies for the high-quality development of the rare earth industry are continually being refined and improved, and rare earth resource security has been elevated to a core dimension of the national security system. Through strict policy controls, technological innovation, and green transformation, China’s rare earth industry is transitioning from a resource powerhouse to an industrial leader, entering a new era of high-quality development.

Global Rare Earth Supply Growth Slows, and the Rigid Supply Logic May Strengthen Further

According to USGS data, global rare earth mine production in 2024 was 390,000 tons, with China producing 270,000 tons, accounting for 69% of global production. In terms of production quotas, the annual rare earth mining quota for 2024 was 270,000 tons, representing a year-on-year increase of 5.9%, though the growth rate declined by 15.5 percentage points compared to the previous year. We expect the growth rate of rare earth quotas to continue slowing. On the import front, data from the General Administration of Customs shows that from January to November 2025, China’s cumulative rare earth ore imports decreased by 25.1% year-on-year. We project that global rare earth supply will reach 513,000 tons by 2028, with a CAGR of 5.6% from 2024 to 2028, indicating a sustained slowdown in growth.

Rare Earth Permanent Magnet Materials Have Broad Applications, with Rapid Demand Growth in New Energy Vehicles, Industrial Motors, and Inverter Air Conditioners

According to Argus, rare earth permanent magnet materials account for 26% of global rare earth consumption and approximately 74% of consumption value. We estimate that by 2028, new energy vehicles in China and overseas will drive incremental demand for high-performance neodymium iron boron (NdFeB) by 90,000 tons and 41,000 tons, respectively, with CAGRs of 19.3% and 20.0% from 2024 to 2028. Benefiting from increasing penetration rates, demand in the industrial motor and inverter air conditioner sectors is expected to rise to 58,000 tons and 27,000 tons by 2028. Global demand for high-performance NdFeB is projected to reach 369,000 tons, with downstream sectors such as new energy poised to maintain long-term, high-speed development momentum.

Humanoid Robots and the Low-Altitude Economy Are Expected to Become New Growth Drivers for Rare Earth Permanent Magnet Demand

Motors used in robots require characteristics such as rapid response, high starting torque-to-inertia ratio, and precise motion control. High-performance NdFeB permanent magnet materials, known for their high reliability and stability, are ideal for robot motors, enabling core components to achieve lightweight designs and fast responses. This positions them to benefit significantly from the large-scale production of robots in the future. We project that demand for NdFeB in emerging sectors (humanoid robots and the low-altitude economy) will increase to 33,000 tons by 2035, accounting for 5.5% of total demand, and is expected to rise further to 7.6% by 2040.

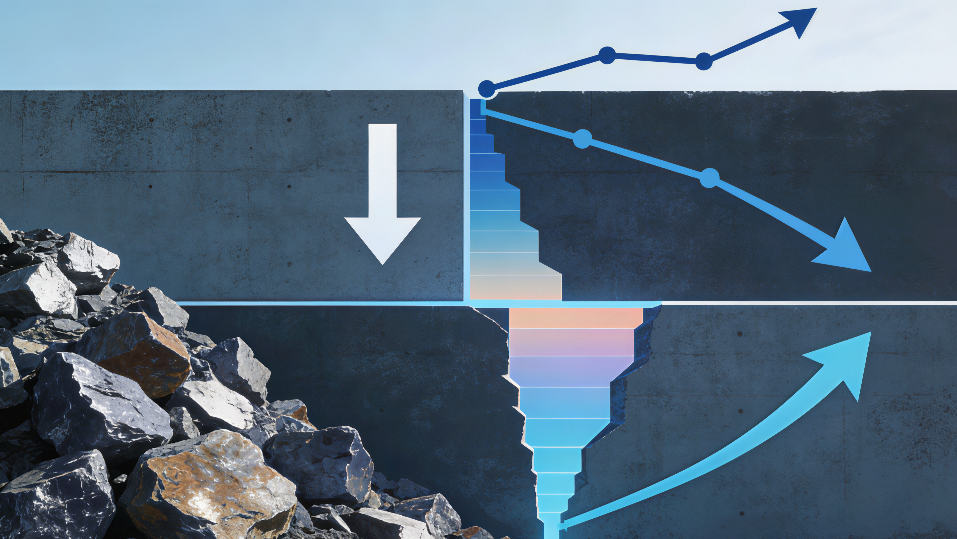

The Global Rare Earth Supply-Demand Gap May Widen Continuously Starting in 2026, with Rare Earth Prices Expected to Remain Stable or Trend Upward

We estimate that the global supply-demand gaps for praseodymium-neodymium oxide in 2025, 2026, 2027, and 2028 will be -5,000 tons, -9,000 tons, -13,000 tons, and -21,000 tons, respectively. Considering the overall supply-demand dynamics, the rare earth market is expected to experience tightening conditions. Demand from sectors such as new energy vehicles, air conditioners, and industrial robots continues to grow, and the acceleration of humanoid robot commercialization is likely to unlock long-term demand growth for rare earth permanent magnets. Additionally, the gradual recovery of exports, combined with the rigid supply of imported ores from Southeast Asia, is expected to support steady or upward rare earth prices. This, in turn, will drive sustained improvements in the profitability of companies across the industry chain. We anticipate that the price center for praseodymium-neodymium oxide could rise to the range of 600,000–800,000 yuan per ton in 2026.

Risk Factors

Factors such as slower-than-expected industrialization of humanoid robots, fluctuations in rare earth raw material prices, slower development of the low-altitude economy, faster-than-expected expansion of rare earth development overseas, weaker-than-expected enforcement of policies targeting illegal mining and environmental protection, and risks related to import-export policies.

Investment Strategy

The strategic positioning of rare earth resources continues to be upgraded, and the rare earth industry is entering a new era of high-quality development. On the supply side, slowing quota growth coupled with declining imports further strengthens the rigid supply logic of the rare earth industry. On the demand side, downstream sectors such as new energy vehicles, industrial motors, and inverter air conditioners are expected to maintain long-term, high-speed development momentum. Emerging fields like humanoid robots and the low-altitude economy are likely to become core drivers of long-term growth in high-performance NdFeB demand. We anticipate that the global rare earth supply-demand gap will widen continuously starting in 2026, providing long-term support for rare earth prices and driving sustained improvements in the profitability of companies across the industry chain. We recommend the allocation value of the rare earth permanent magnet industry chain.