On October 30, the three major A-share indices opened lower, with the Shanghai Composite Index dropping by 0.21%, the Shenzhen Component Index falling by 0.22%, and the ChiNext Index declining by 0.32%. After a slight initial decline, the MSCI China A50 Connect Index, which represents core leading assets, rebounded. The constituent stocks showed mixed performances, with Bank of China, Focus Media, and Ningbo Bank leading the gains, while Cambricon Technologies (U) and Haiguang Information led the losses.

The Chief Strategist of Dongfang Securities stated that most global major economies’ stock markets have reached new short-term highs, while A-shares' main indices are still far from historical peaks, presenting a clear valuation advantage. As the results of China's industrial upgrades become evident, global funds will reassess the investment value of Chinese assets.

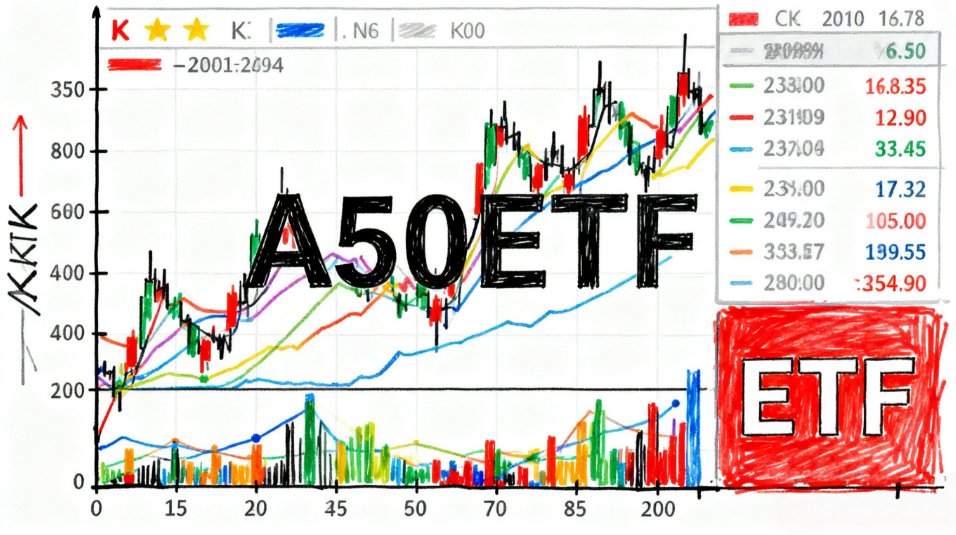

The A50 ETF (159601) closely tracks the MSCI China A50 Connect Index, offering a one-click package of 50 leading connectable stocks. It provides balanced coverage of core leading assets in the A-share market, making it a preferred choice for both domestic and international funds. Compared to other "beautiful 50" indices, the MSCI China A50 Connect Index places more emphasis on liquidity and industry balance during its construction process, with a significant large-cap characteristic.