On the morning of November 19, the three major Hong Kong stock indices showed mixed performance. Among mainstream ETFs, the largest A-share tracker in the same segment, the Hang Seng Tech Index ETF (513180), fluctuated in line with the index. Among its holdings, Alibaba, Trip.com Group, and XPeng Motors led the gains, while Xiaomi Group, Tongcheng Travel, Li Auto, and Kuaishou were among the top decliners, with Xiaomi Group falling over 3% after its earnings report.

In a recent research report titled "Hang Seng Tech Sees Counter-Trend Inflows, Divergence in U.S. Equity Fund Flows," China Securities Co., Ltd. pointed out that the Hang Seng Tech Index experienced significant net inflows over the past month, followed by the Nasdaq 100, among others. Net outflows were relatively small, with the China Internet 50 and Hang Seng Index seeing minor net outflows. Overall, continuing the trend from the previous month, despite some adjustments, the Hong Kong tech growth sector maintained high investment interest and further concentration, while the popularity of high-dividend stocks declined.

At the instrument level, the Hang Seng Tech Index ETF (513180), as the largest in its segment in the A-share market, has become a "hot favorite" for capital. Data shows that on November 18 alone, this ETF attracted approximately ¥725 million in net inflows. Over the two trading days this week, its cumulative net inflows reached as high as ¥1.24 billion, demonstrating strong "capital attraction" capabilities.

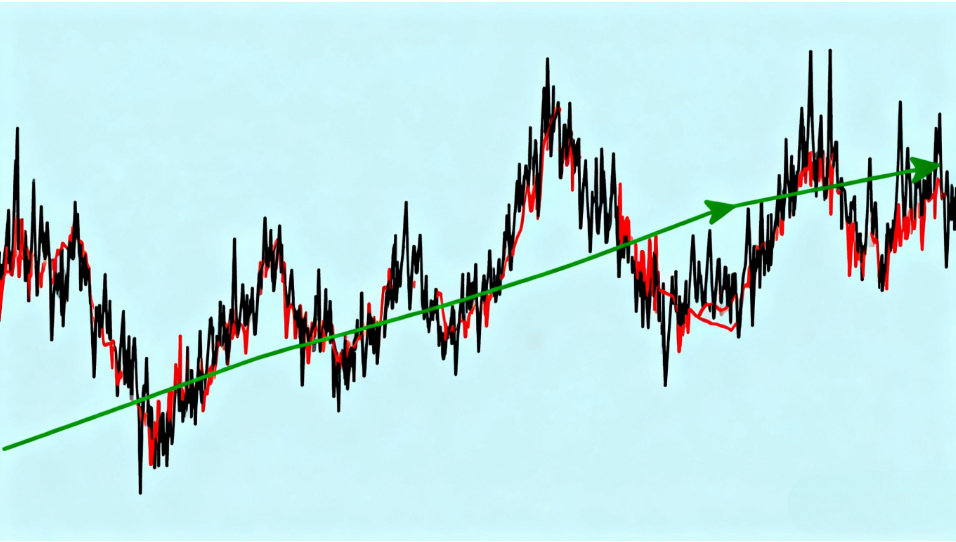

From a valuation perspective, as of November 18, the latest valuation (PE-TTM) of the Hang Seng Tech Index ETF (513180) was 21.84 times, lower than other major global tech indices. Additionally, the index valuation is at approximately the 22.19th percentile since its launch, meaning the current valuation is lower than over 77% of its historical levels. Dongwu Securities believes that Hong Kong tech stocks are still in a short-term adjustment phase. Since early October, the narrative of an AI bubble in U.S. stocks has resurfaced, coupled with a lack of new catalysts in the industry recently, leading to insufficient upward momentum for Hong Kong AI tech stocks. With Nvidia's earnings report approaching, the market is still waiting for signals. However, the institution believes that from a medium- to long-term perspective, the current position of Hong Kong tech stocks is highly attractive.

The Hang Seng Tech Index is already in a historically undervalued range, highlighting its cost-effectiveness, while its high volatility and growth potential give it greater upward momentum. Investors without a Hong Kong Stock Connect account can use the Hang Seng Tech Index ETF (513180) to easily invest in China's core AI assets.