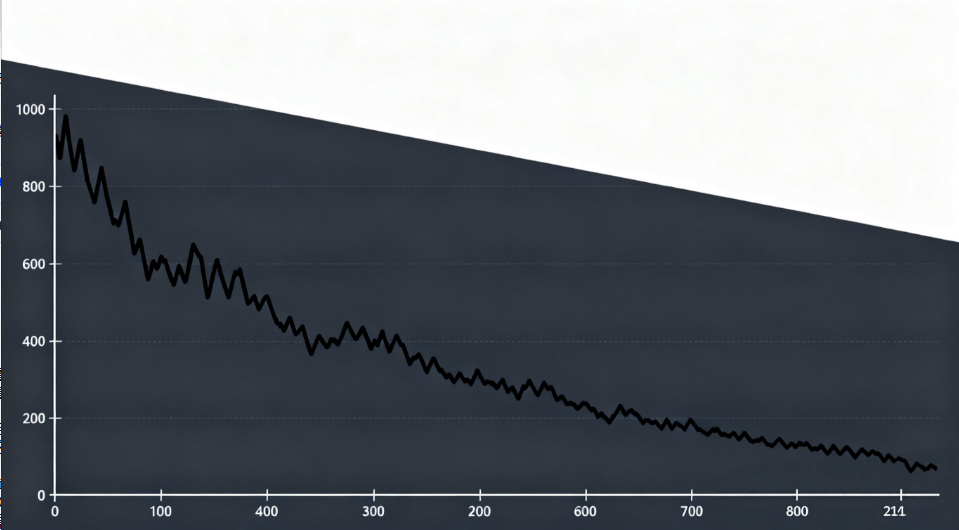

On November 21, the main U.S. crude oil contract fell 1.73% to close at $57.98 per barrel, down 3.51% for the week; the main Brent crude contract fell 1.42% to close at $62.48 per barrel, down 2.97% for the week.

Baocheng Futures believes that the latest OPEC quarterly report directly flipped the global oil market from "supply falling short of demand" in the third quarter to "a daily surplus of 500,000 barrels," amplifying expectations of loose supply. However, as geopolitical factors became more prominent, with the boost of optimistic funds, crude oil futures prices showed a trend of fluctuating and stabilizing. Currently, the weak supply and demand structure of the oil market is grappling with increasingly prominent geopolitical sentiment. After digesting the positive factors from the rebound in European diesel prices, the oil market is once again facing oversupply pressure.

Since April this year, OPEC+ has begun to gradually phase out the previous voluntary production cuts of 2.2 million barrels per day and 1.65 million barrels per day. At the latest meeting in November, it decided to further increase the December production target by 137,000 barrels per day, continuing the gradual production increase model seen in October and November. Meanwhile, the meeting announced that the production increase plan will be paused in the first quarter of 2026.

Everbright Futures Research pointed out that the increase in OPEC+ production and exports has a dual impact on the crude oil and oil tanker markets. On one hand, the supply growth has intensified market concerns about a crude oil surplus, a pressure that is particularly significant during the current global seasonal low demand period for crude oil. The recent OPEC monthly report for November showed that its forecasts for global crude oil demand in 2025 and 2026 remain unchanged at 1.30 million barrels per day and 1.38 million barrels per day, respectively, basically holding steady. However, the report for the first time predicts that global oil supply will match demand next year, marking a further shift from its earlier forecast of a supply shortfall in 2026. At the same time, the IEA also expects that with production increases from OPEC+ and other oil-producing countries, coupled with slowing demand growth, the global oil market could face a supply surplus of up to 4.09 million barrels per day in 2025. On the other hand, the rise in seaborne crude oil exports supports the performance of the oil tanker market from the demand side. The current VLCC utilization rate has risen to its highest level since 2020, with Vortexa data showing the current VLCC utilization rate is about 57%.

On November 21, international precious metal futures closed mixed. COMEX gold futures rose 0.07% to $4,062.8 per ounce, down 0.77% for the week; COMEX silver futures fell 1.27% to $49.66 per ounce, down 2.02% for the week.