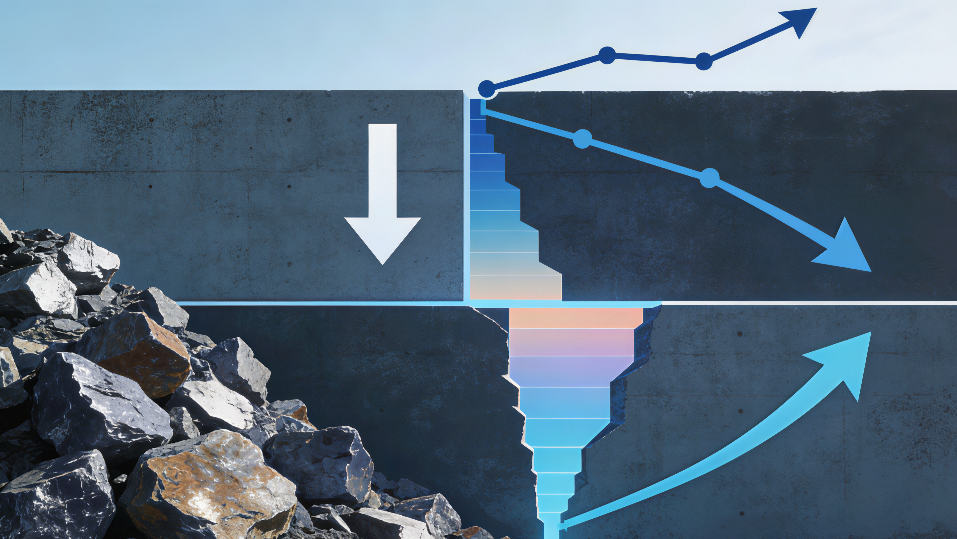

On January 19, investors’ enthusiasm for the prospects of artificial intelligence (AI) is expected to continue driving the rise of large tech stocks this year. At the same time, Wall Street also anticipates that the U.S. stock bull market will "bloom in multiple areas" this year. Over the past two weeks, the industrial, materials, energy, and consumer staples sectors have outperformed the broader market, with each of these sectors gaining 5.5% or more. Even the small-cap Russell 2000 Index has risen by 8% since the beginning of the year, surpassing the S&P 500, which has increased by just over 1% during the same period. John Stoltzfus, chief investment strategist at Oppenheimer, stated, "This is a broadening bull market."

Stoltzfus has set a target price of 8,100 points for the S&P 500 Index this year, implying that the index will rise by approximately 17% from its current level—the most optimistic forecast on Wall Street. Most other analysts expect the benchmark index to achieve double-digit percentage growth, with target prices set at 7,500 or 7,600 points. He added, "What we are seeing is a rotation, and it is not necessarily a sell-off in tech stocks as we might imagine. It is profit-taking aimed at expanding the investment scope and achieving diversification."