Top 10 Most Famous EAs You Must Know: Martingale and Scalping

With the continuous development of the forex market and advancements in computer technology, automated trading (Expert Advisors, or EAs) has become widely recognized among investors. Martingale, scalping, grid, trend-following, Turtle—there is a dazzling array of EAs on the market, with varying quality. Which type of EA is the best? Even beginners are confused, and even seasoned traders may not fully understand. Below, I will share with fellow traders the core differences, advantages, and disadvantages of several mainstream EAs.

1. Martingale EA

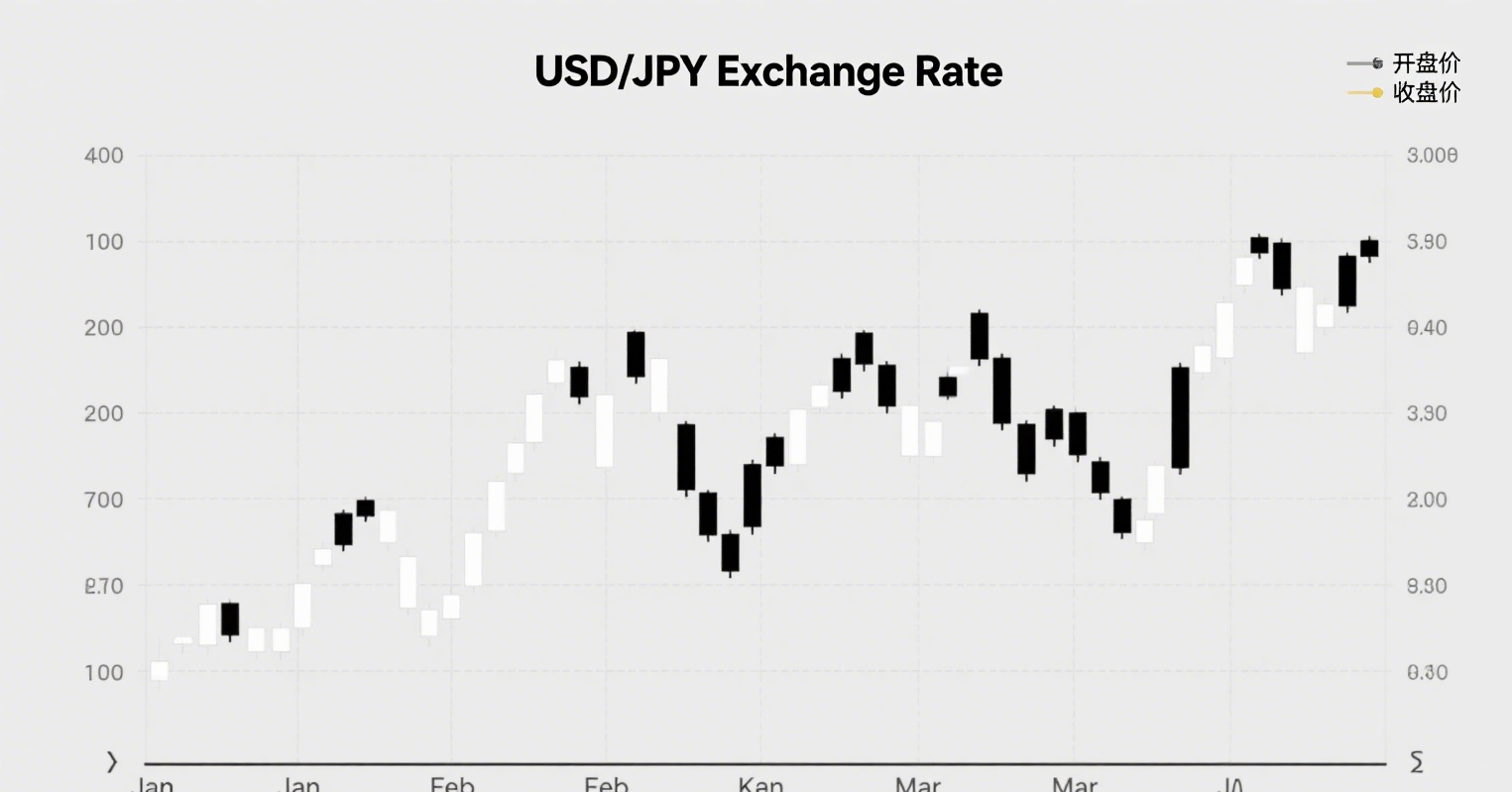

Martingale is one of the most popular and widely used EAs in the market. It is a money management method that starts with small positions, gradually increases them, and closes all positions upon reaching the profit target. Since Martingale is mostly used in ranging markets, we’ll take the ranging Martingale as an example.

Advantages:

-

Especially suitable for ranging markets, offering very stable profits.

-

Even after a retracement, a slight pullback can lead to profitable closing.

Weaknesses:

-

Struggles with strong trending markets, testing its resilience.

Improvement Strategies:

-

Increase the interval between position additions to avoid sudden market movements triggering excessive orders.

-

Set a stop-loss line to prevent margin calls.

-

Implement manual risk control, as large floating losses require strong risk management.

Ideal Scenario:

Martingale works best when the market moves sideways (flat red line), but it is unsuitable during sharp upward or downward trends (steep red line). In practice, different market conditions require different strategies.

2. Scalping EA

Scalping generally falls into two categories:

-

Small positions with unconditional high-frequency trading, exiting as soon as a profit is made.

-

Technical entry points with large positions, also exiting quickly upon profit.

Thus, scalping EAs generate minimal profit per trade but execute a high volume of trades. They demand extremely low spreads and optimal trading conditions, often existing primarily to generate commissions for brokers.

Advantages:

-

Easy to exit trades, relying on high volume and win rate for profitability.

Weaknesses:

-

Only suitable for small, predictable ranging markets—even minor trends can severely impact performance.

Improvement Strategies:

-

Choose brokers with low spreads or trade instruments with minimal spread costs.

Scalping is not a highly recommended EA type due to its poor adaptability to market changes, making it suitable only for foreseeable ranging conditions.

Today’s discussion ends here. In future updates, we will explore other EA types, culminating in a super heavyweight EA reveal—several optimized and hybrid EAs that have undergone backtesting and real-world trading over nearly two years, delivering highly satisfactory annualized returns.

"The above views and analysis are solely the author’s personal opinions, provided for reference only, and should not be considered trading advice. Trade at your own risk!"