Unveiling the Most Promising Investment Opportunities

-

Stock Market: Seize the Growth Trends in Emerging Industries!

In July, the stock market will present exciting investment opportunities, particularly in companies related to emerging industries such as technology, renewable energy, and electric vehicles. These sectors possess tremendous growth potential, and investors should closely monitor and capitalize on these trends to achieve substantial returns.

Recently, the new energy vehicle market has shown rapid growth. With increasing environmental awareness and government support for clean energy, the electric vehicle industry is thriving. Investors can focus on stocks in related fields, such as EV manufacturers, battery producers, and charging infrastructure companies. By conducting in-depth research and selecting high-potential companies, you can benefit from the growth of the EV industry.

-

Forex Market: Capitalize on Opportunities from Global Economic Shifts

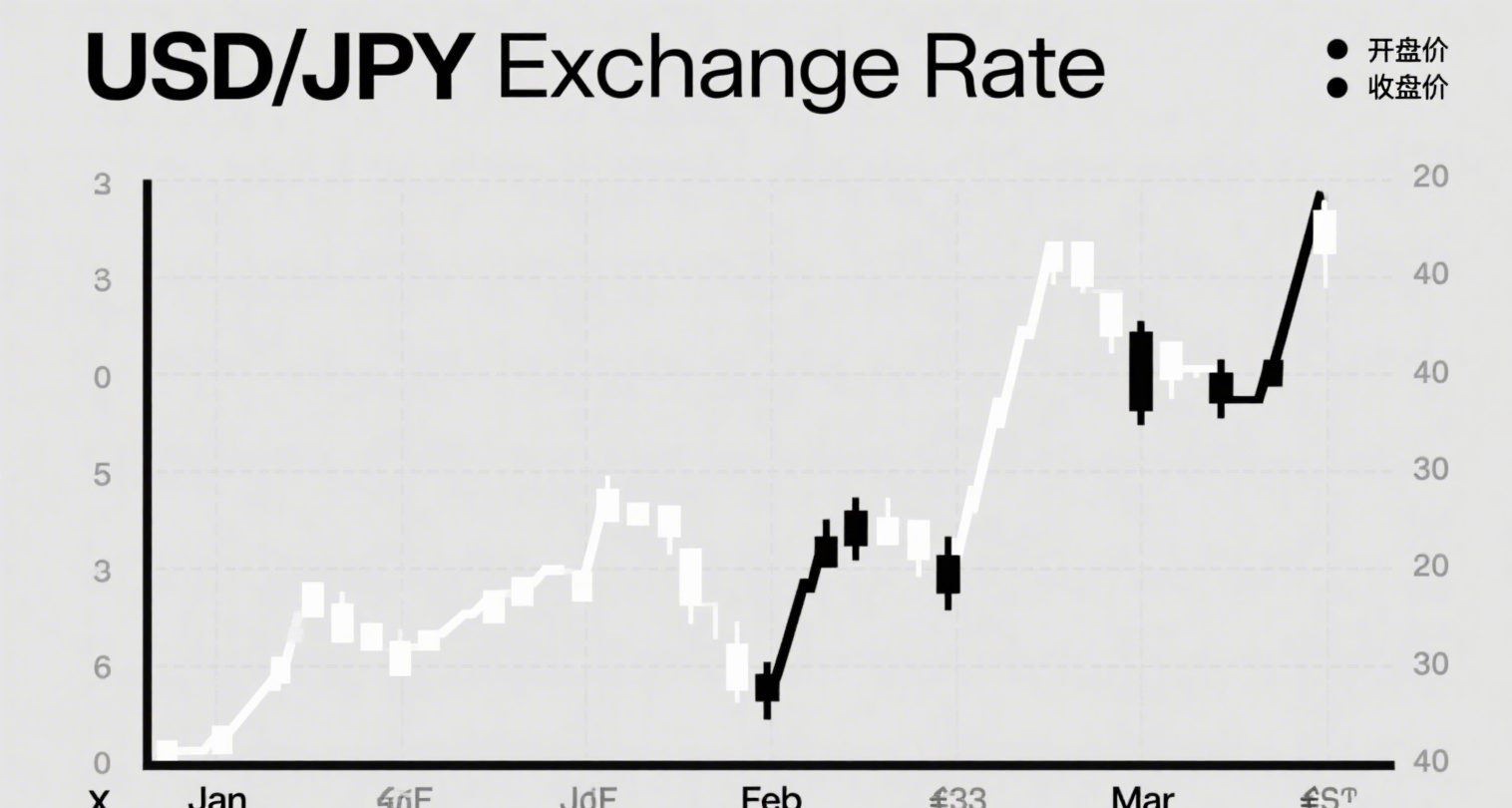

Changes in global economic conditions and monetary policies present numerous investment opportunities in the forex market in July. Keep an eye on major currency pairs, such as USD, EUR, and GBP, to profit from exchange rate fluctuations. Recently, the global economic recovery has been strong, which may significantly impact currency exchange rates. Investors should closely monitor economic data and central bank policies to identify forex trading opportunities.

Additionally, the cryptocurrency market remains a hot sector in forex trading. Bitcoin, Ethereum, and other cryptocurrencies may continue their strong upward momentum in July. Investors can track crypto trends and market insights to seize profitable opportunities.

-

Commodities: Exploit Investment Opportunities from Supply-Demand Shifts!

The commodities market will also offer compelling investment opportunities in July. Focus on energy, metals, and agricultural products such as crude oil, gold, copper, and soybeans to track global supply-demand dynamics. Recently, energy markets have experienced significant price volatility due to geopolitical risks and supply-demand imbalances. Investors can analyze supply conditions, global demand, and market expectations to identify profitable trades in energy markets.

Moreover, gold, as a safe-haven asset, remains a key focus for investors. Rising global economic uncertainty and inflationary pressures may drive gold prices higher. Investors should monitor gold market trends and act promptly to capitalize on potential gains.