estment focuses on four levels: Global investment focuses on four levels:

1). The real-time background and issues of international politics, geopolitics, and major power strategies. Issues at this level are factors that shape the medium- to long-term trends in investment markets.

2). The global economy—whether it functions well or poorly—is related to investment markets on one hand and to resource demand and supply equilibrium on the other. This aspect creates investment value.

3). The international financial situation. If it is relatively stable, the structural distribution, total amount, and scale of hot money (speculative capital) will also be relatively stable. As a result, conventional mechanisms in investment markets will manifest more fully, while abnormal mechanisms will appear less frequently, and vice versa.

4). The structural distribution of hot money (referring to capital detached from the cycle of economic resource allocation and characterized by profit-seeking) across different financial markets.

Market movements are random and unpredictable. The only thing you can do is wait silently and patiently. At most, you can use signals as reminders during specific periods, and before signals appear, take breaks or engage in other tasks. However, the hardest part is this: those who enter the trading industry seeking freedom tend to have a more casual personality and lack patience, which inevitably leads to poor execution.

Programming tests are a good method to save significant time costs. They allow ideas to be verified quickly. The purpose of testing is to validate ideas, identify correlations among various methods, and rapidly accumulate experience. This enables one to move swiftly from complexity to simplicity. Every method has its pros and cons, and pursuing perfection will only lead to the bottomless abyss of data optimization.

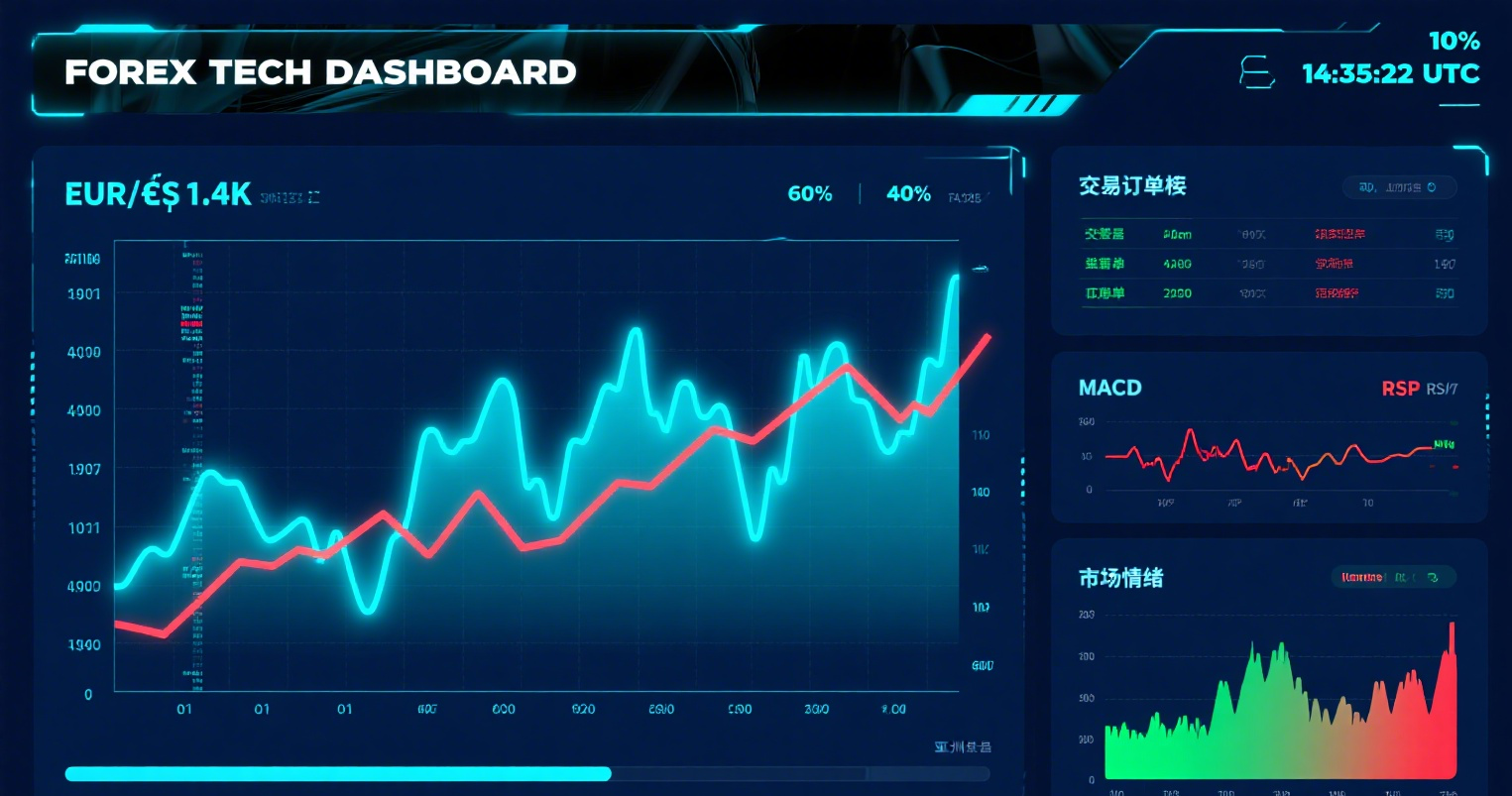

Forex trading has the characteristic of starting from scratch. However, this is only achievable on the basis of stable profits. Here, "stable" refers to consistency, not speed or sudden wealth. A stable trader who earns 10%–20% monthly gains will find the market's capital pool astonishingly large—it’s you choosing the capital, not the capital choosing you.