The Chill of Tariffs Felt First by Consumption: US Consumer Companies Cautiously Assess Second-Half Performance Trends

As US second-quarter earnings reports are gradually released, one of the market’s biggest concerns is the extent of the impact of US tariffs on businesses. Judging from the performance of consumer companies that have already reported, the situation may not be optimistic.

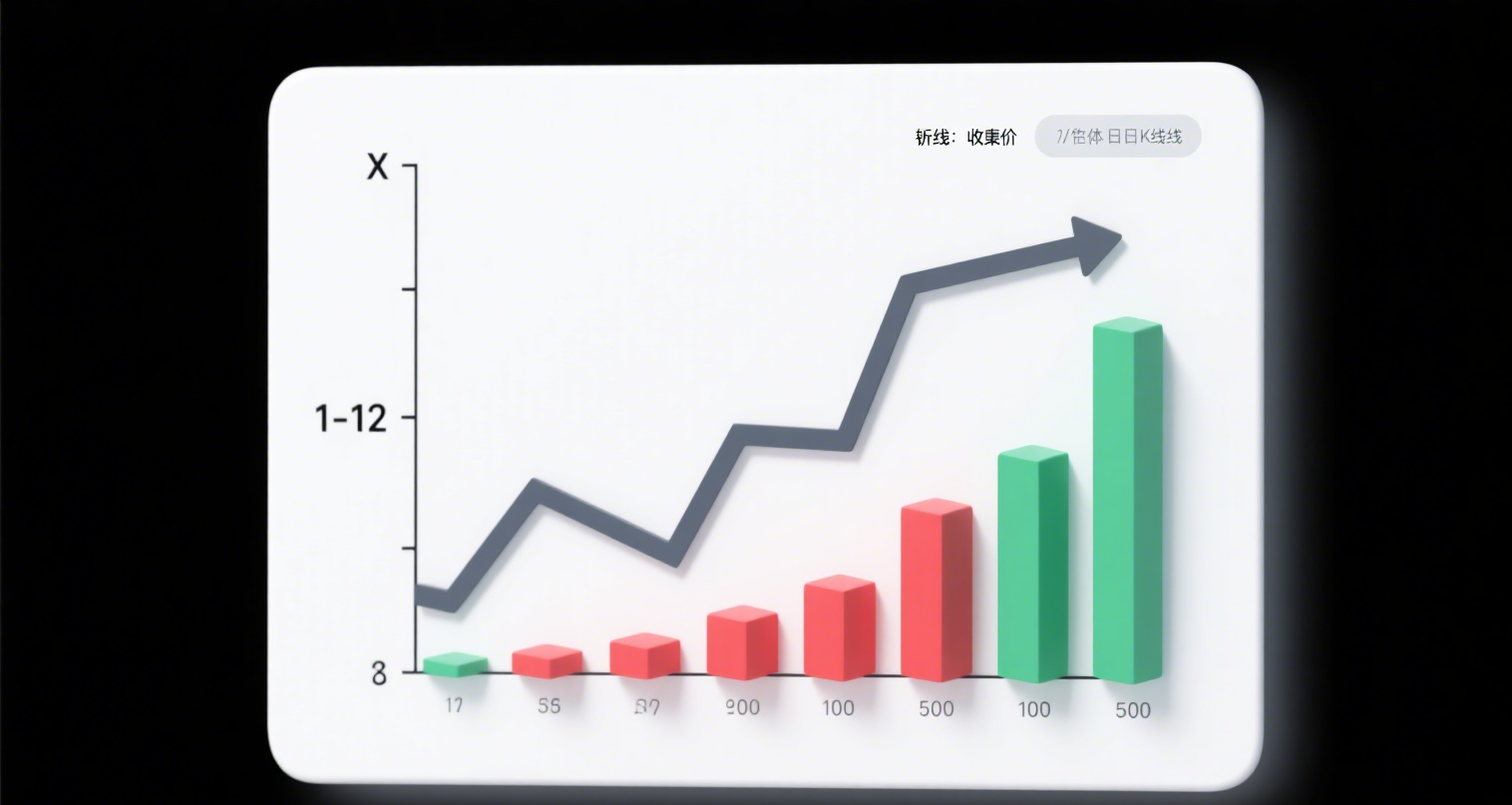

According to a survey, since February 1, more than 300 companies have issued warnings about tariffs, at least 38 consumer goods companies have withdrawn or lowered their performance forecasts, and 42 companies have decided to raise prices.

Analysts worry that amid mixed sales and profit forecasts, the US shopping season in the second half of the year and the year-end may perform weakly, endangering the resilience of US consumers. In addition, as tariffs have increased the cost of hundreds of goods, the US inflation outlook is equally severe.

Michael Fiddelke, Target’s incoming CEO, further pointed out that product value is currently consumers’ top concern. They are also expanding their budgets and finding ways to cope with the uncertainty brought by inflation and tariffs.

Target stated that it would consider price hikes as a last resort, while home improvement retailer Lowe’s hopes to overcome challenges by maintaining price competitiveness. The company’s second-quarter profits exceeded expectations, but it also warned that due to high borrowing costs, US home improvement demand remains weak, and second-half performance will face challenges.

Lowe’s competitor, Home Depot, reported disappointing Q2 results, stating that consumers are now hesitant to purchase big-ticket items.

In addition, over the past few weeks, Adidas indicated it may launch new products at higher prices in the US, Levi’s said it would reduce promotions, and Under Armour is considering raising prices to counter tariffs…