On the morning of October 30, the Hong Kong stock market opened with a significant gap up.

As of the time of reporting, the Hang Seng Index opened at 26,545.92 points, up 199.78 points or 0.76%.

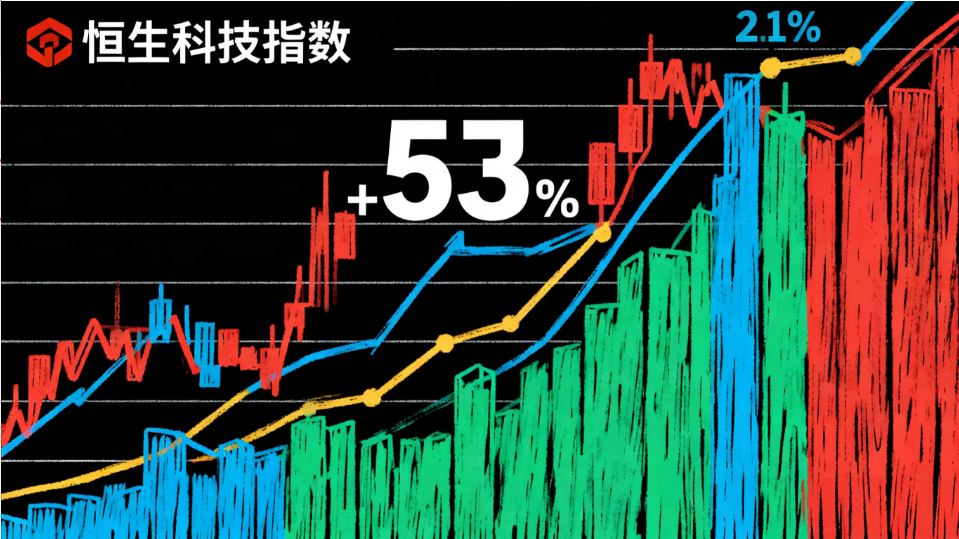

The Hang Seng Tech Index opened at 6,125.63 points, up 32.19 points or 0.53%.

Market News: The US Federal Reserve implemented a second consecutive 25 basis point rate cut, bringing the target range to 3.75%-4.00%, matching market expectations. It also announced it would begin halting balance sheet reduction (QT) in December. Fed Chair Powell indicated a potential pause in rate cuts in December. Concurrently, the Hong Kong Monetary Authority lowered its base rate by 25 basis points to 4.25%. In US stock news, Nvidia historically reached a $5 trillion market capitalization, with a series of agreements announced by its CEO Jensen Huang fueling the AI boom to new heights.

Hong Kong Stock Performance: The non-ferrous metals sector strengthened again. Among them, Aluminum Corporation of China (Chalco) (02600.HK) and Nanshan Aluminum International (02610.HK) rose over 7%. China Silver Group (00815.HK), Jiangxi Copper (00358.HK), Northern Mining (00433.HK), and Ganfeng Lithium (01772.HK) gained over 6%. China Hongqiao (01378.HK) advanced over 5%. Additionally, sectors like wind power, coal, and semiconductors led the gains in early trading.

Other Sectors: Most technology stocks opened higher. JD.com, Bilibili, and Kuaishou rose over 2%. Tencent, Alibaba, Meituan, and Lenovo increased over 1%. NetEase opened nearly 6% lower but subsequently narrowed its losses. Apple concept stocks opened higher, with Hon Hai Precision (FIT) rising over 7%. Chinese brokerage stocks generally rose, with Guolian Minsheng up over 3%. Automobile stocks were active, with XPeng Motors climbing over 3%. Gold stocks rebounded, as Zijin Mining gained over 3%.

Market Outlook:

Morgan Stanley believes Hong Kong stock valuations remain significantly lower than global markets and benefit from China's economic recovery, a weaker US dollar, and the start of the Fed's rate-cutting cycle. The firm notes that Hong Kong's status as an international financial center is solid, and coupled with the HKEX's new IPO rules and the deepening of the Stock Connect programs, will continue to attract global capital inflows.

Foreign institutions like J.P. Morgan believe that despite significant gains this year, Hong Kong stock valuations are still relatively low compared to global markets, and they expect the current upward trend could potentially continue into 2026.

China Merchants Securities International suggests focusing on "turnaround" opportunities in the consumer staples sector. Meanwhile, within the financial sector, insurance stocks are also receiving institutional attention due to "perception gap" discounts and high dividend yields. Huatai Securities has also observed marginal improvements in the mass consumption and high-dividend sectors.