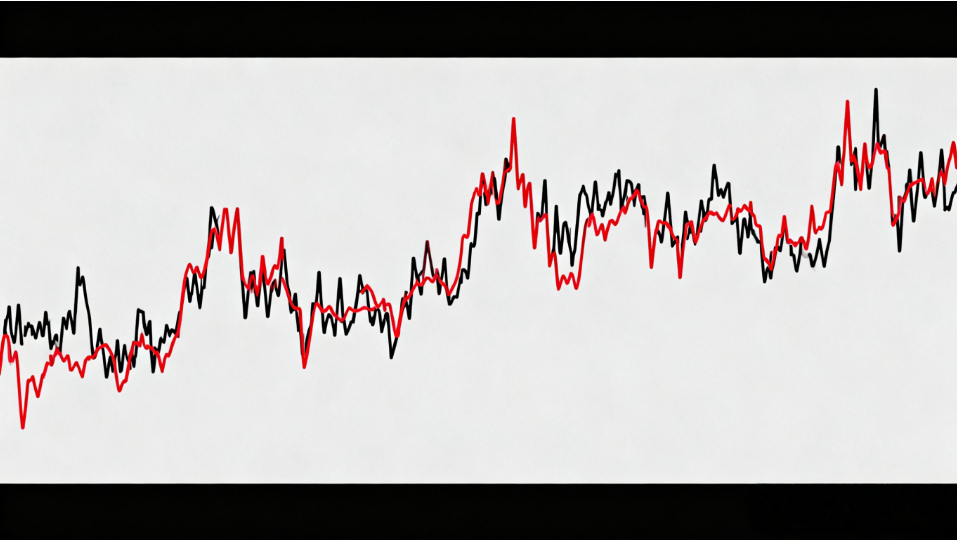

In its latest "2026 Global Equity Outlook" report, J.P. Morgan has shifted from its previously cautious stance on the U.S. stock market to make a striking prediction: by 2026, the S&P 500 index could surpass the 8,000-point milestone. The report, led by Dubravko Lakos-Bujas, Global Head of Market Strategy at J.P. Morgan, and his team, raised the baseline target for the S&P 500 to 7,500 points. It further noted that if the Federal Reserve's monetary policy proves more accommodative than market expectations, the index might even test the 8,000-point level next year. This optimistic forecast reflects growing institutional confidence in the medium- to long-term trajectory of U.S. stocks, particularly against the backdrop of increasing possibilities of an economic soft landing and improved corporate earnings expectations.

Notably, this prediction does not stand alone. During the same period, Vivek Arya, an analyst at Bank of America, also provided a positive assessment of the future growth of the artificial intelligence (AI) data center market. According to his analysis, the global AI data center market is expected to surge from $242 billion this year to approximately $1.2 trillion by 2030, representing a nearly fivefold remarkable growth. This trend not only highlights the strong momentum of infrastructure investment driven by AI technology but also provides robust support for the performance growth of related tech companies. In this process, NVIDIA, as a leader in the AI chip sector, is expected to maintain its market dominance, although its market share may slightly decline from the current estimated 85% to 75%. Bank of America has reiterated its "buy" rating for NVIDIA, demonstrating continued market recognition of its long-term competitiveness.

Combining these two predictions, it is not difficult to see the close logical connection between them. The rapid expansion of the AI data center market will not only directly drive the development of related industries such as semiconductors, cloud computing, and data center construction but is also likely to bring new growth momentum to many technology companies, including those in the S&P 500. The technological leadership and ecosystem布局 of key companies like NVIDIA position them advantageously in the AI wave, thereby potentially supporting the overall stock index performance. To some extent, J.P. Morgan's optimism about the future trajectory of the S&P 500 is based on its judgment of the structural dividends from AI and other high-growth technology sectors.

Of course, market predictions often come with uncertainties. The path of the Federal Reserve's monetary policy, progress in inflation control, changes in the global economic environment, and potential shifts in the competitive landscape due to technological iterations will all impact the final market performance. However, from the current analysis of institutions, technology-driven factors, particularly the industrial upgrades and corporate earnings improvements fueled by AI, have become a key narrative supporting the medium- to long-term bullish trend of the stock market. If these expectations are gradually realized, the S&P 500's move toward 8,000 points may not only represent a numerical breakthrough but also symbolize a substantial boost in market confidence under a new cycle of technology investment.