CSI 300 Index Futures refer to financial futures contracts based on the CSI 300 Index as the underlying asset. The contract months for CSI 300 Index Futures are the current month, the next month, and the following two quarterly months. Below is a detailed explanation.

The quarterly months for CSI 300 are March, June, September, and December. The last trading day for CSI 300 Index Futures contracts is the third Friday of the contract month, which is also the delivery day. If the last trading day falls on a national holiday or trading is suspended due to exceptional circumstances, the next trading day will be considered the last trading day and delivery day. On the next trading day after the delivery of the expiring contract, trading for the new monthly contract begins.

Compared to stock trading, CSI 300 Index Futures feature two-way trading, high leverage, high liquidity, and low transaction costs. These characteristics are absent in stock trading and are reflected in the following aspects:

Two-way trading: Whether in a bull or bear market, investors can profit through index futures trading—using speculative strategies such as long or short positions. The two-way trading mechanism multiplies the profit opportunities of the CSI 300 Index compared to other investments, allowing gains whether the market rises or falls.

High leverage: Currently, the draft proposal for CSI 300 Index Futures stipulates a margin ratio of 12%, resulting in an investment leverage of 8.3 times. This leverage comes with no capital cost. The only requirement is maintaining sufficient cash flow for potential margin calls under the daily mark-to-market settlement system.

High liquidity: Investments in stocks or stock indices are often constrained by the size of tradable market capitalization. However, the ability to open positions in both directions and the T+0 trading mechanism eliminate this limitation in index futures speculation.

Low transaction costs: Futures trading fees are generally in the range of a few ten-thousandths of the contract value, whereas stock trading costs are around a few thousandths, making futures trading extremely cost-effective.

Due to these features, CSI 300 Index Futures have become increasingly popular among investors in recent years, with the number of accounts and trading volumes rising year by year. Many investors have turned small investments into substantial wealth—highlighting the profit potential and allure of trading CSI 300.

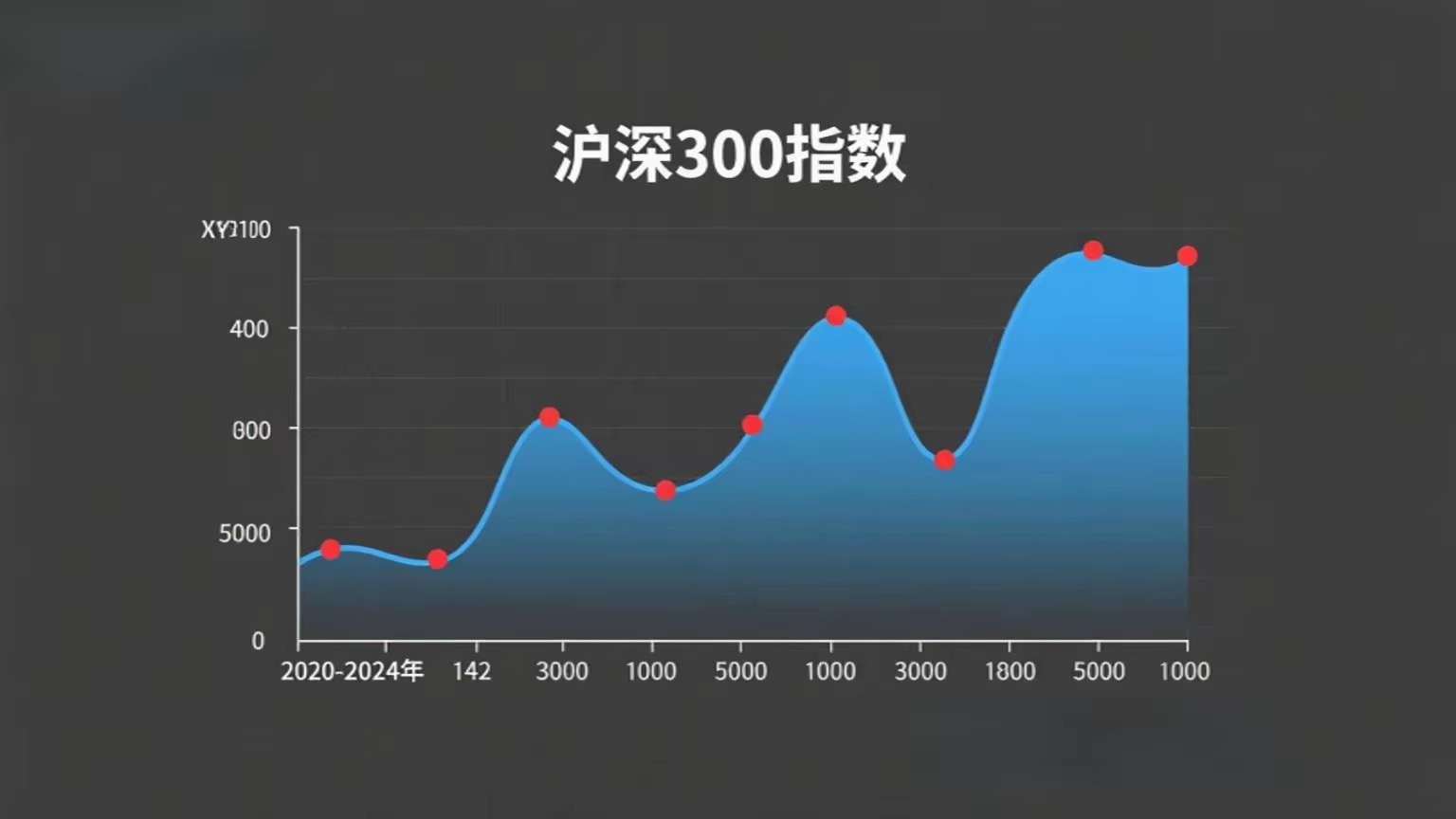

Looking at recent market trends, CSI 300 Index Futures have experienced significant volatility. Currently, the China Securities Regulatory Commission (CSRC) requires listed companies to choose one of five measures to boost market confidence: major shareholder buybacks, stock repurchases, increases in holdings by directors and executives, equity incentives, or employee stock ownership plans. The CSRC encourages listed companies to adopt measures beyond these to stabilize stock prices.

Additionally, the IPO process has effectively been suspended, and the registration-based issuance system may also slow down. Reports indicate that only feedback meetings for initial and secondary offerings are being held, while preliminary and issuance review meetings have been suspended. Multiple sources confirmed this to NetEase Finance, suggesting that the IPO suspension could last up to six months.

Futures indices continued their sharp rebound, with the IC contract hitting the limit-up, the IF contract briefly reaching limit-up during the session, and the IH contract rising nearly 4%, making it the weakest performer among the three major futures indices. The Shanghai and Shenzhen markets showed early signs of divergence. This article shares some index futures investment knowledge and techniques. Follow Gaohan (WeChat/Baidu: gaohan337) for scientific investing and stable high returns. The recent cliff-like market decline has ended, but after the short-term rebound, individual stocks and sectors are expected to diverge next week. Sustained index gains are unlikely, and the market is likely to enter a consolidation phase.