Can the Bull Market Return?

I. Why Did the 2015 Supply-Side Reform Produce Super Bull Stocks?

The supply-side reform a decade ago created many bull stocks:

As we can see, in 2015 when supply-side capacity reduction was proposed, cement prices were falling. The real rise in cement prices occurred from 2016 to 2017. Was it due to the supply-side reform eliminating excess capacity? Or would this excess capacity have naturally shut down due to falling market prices? Was it a mandatory shutdown or a market-driven behavior?

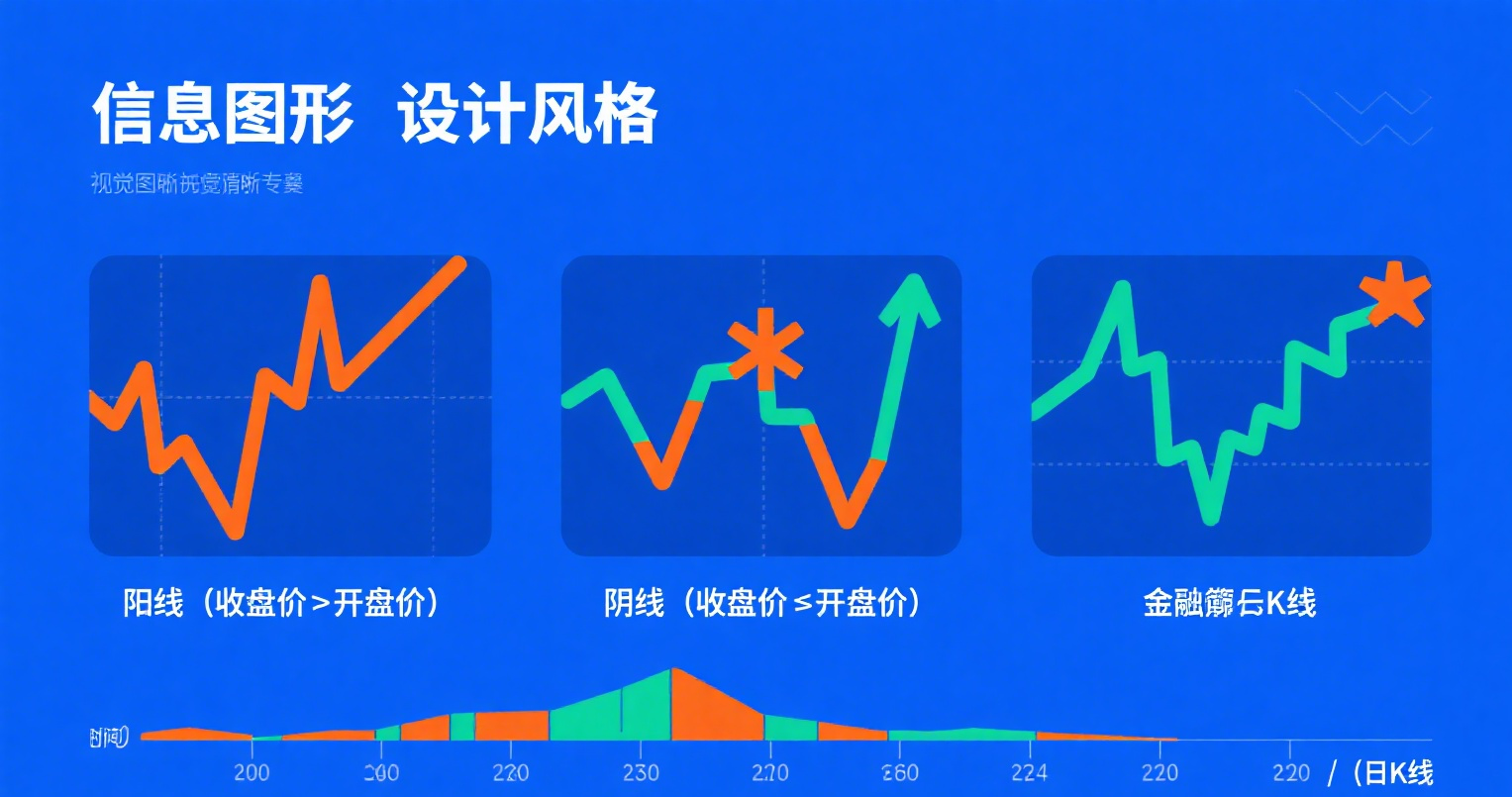

At 220 yuan per ton of cement, most cement companies would shut down on their own—no supply-side reform needed. If excess capacity is bound to shut down when prices are low enough, then whether or not there is supply-side reform, excess capacity would still be eliminated. So, is supply-side reform a necessary condition for shutting down excess capacity? Or is a sufficiently low price the real necessary condition?

The presence of supply-side reform doesn’t matter for shutting down capacity; if prices are low enough, companies will shut down whether they want to or not. Another question is: After excess capacity is shut down, will product prices necessarily rise? And will that lead to a surge in company performance and stock prices?

II. Capacity Reduction Has Little to Do with Improved Performance

Cement prices only surged after 2017, driven by the shantytown renovation policy and a rebound in real estate, which led to booming commercial housing sales. This pushed cement prices from around 200 to 400, stabilizing at 400–500 for many years. Only then did cement stocks see a surge in performance and stock prices.

In other words, capacity reduction is always triggered by steep price declines causing severe losses for companies. A price surge is always driven by a sharp increase in demand. Without a demand surge, post-capacity reduction, product prices can only reach a break-even point.

III. Capacity Reduction Can Stabilize Prices, but Only a Demand Surge Can Drive a Price Rally

Under the current circumstances, many photovoltaic companies are suffering heavy losses, and their capacity will inevitably be phased out by the market—with or without supply-side reform. Steel is near the break-even point, making capacity reduction difficult; pork prices are slightly below cost, making capacity reduction extremely challenging (companies made huge profits last year and still have cash reserves); cement prices remain around 320, with many companies still profitable—so how can capacity be reduced?

Pork production is dominated by private enterprises, and the government can’t order them to cut capacity. Steel is mainly controlled by central and local state-owned enterprises, so mandatory capacity reduction is possible. But without a real estate recovery, how can steel and cement prices rebound?

Conclusion: This round of supply-side reform can only eliminate excess capacity, with the maximum effect being price stabilization and reduced losses for companies. If product prices—like cement and coal—remain highly profitable, capacity reduction will be very difficult!

During the last supply-side reform, companies facing falling prices didn’t dare to produce, and capacity reduction was market-driven. Then, the shantytown renovation policy created massive demand for real estate (housing prices doubled from 2018–2020), leading to a natural surge in upstream raw material prices.

When will real estate recover this time? When will product prices rebound?