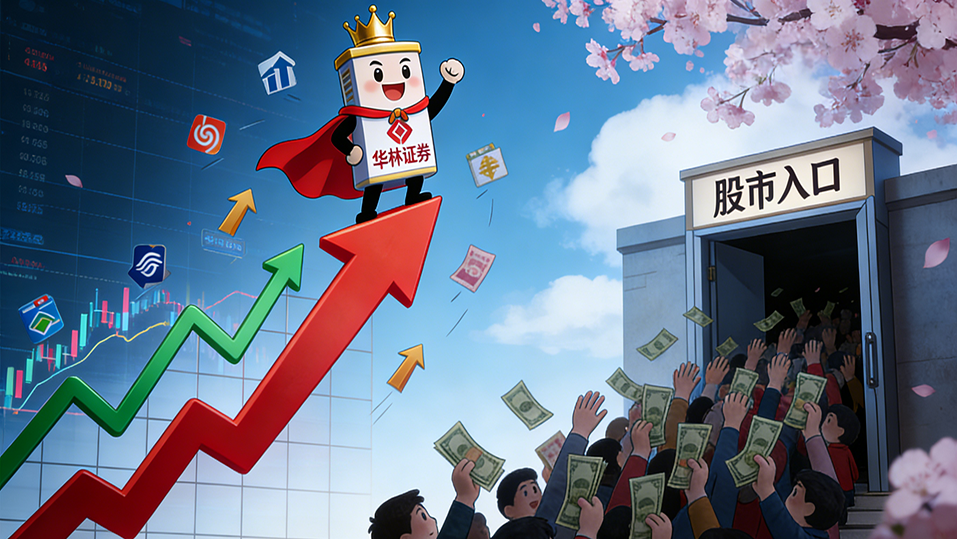

**Morning Session: Brokerage Concept Sector Shows Active Performance.**

Hualin Securities hit the limit-up, Huaan Securities rose over 9%, Tonghuashun surged more than 7%, Compass gained over 6%, Northeast Securities climbed above 5%, Wealth Trend and Guotai Haitong increased over 4%, while Huatai Securities, East Money, DZH, Guolian Minsheng, Tianfeng Securities, and Changjiang Securities all rose more than 3%.

**Kaiyuan Securities Research Report Analysis:**

Regulatory policies have entered an "active" cycle. Brokerage investment banking, public fund, and overseas businesses are expected to take over from traditional operations, supporting the profitability momentum of the securities industry in 2026. Currently, the valuation of the brokerage sector and institutional holdings remain at low levels, with overall underperformance over the past year. The report is optimistic about the sector's layout opportunities at the start of the year, noting that short-term performance forecasts and policy developments are likely to serve as catalysts.

**Hualong Securities Points Out:**

As the first year of the "15th Five-Year Plan" in 2026, the policy environment continues to improve. The recovery of capital market expectations, coupled with high trading activity levels, is expected to drive a dual resonance of valuation and profitability in the brokerage sector. Regulatory authorities are steadily advancing institutional openness, promoting the entry of medium- to long-term funds into the market. The trend of household deposit relocation and long-term investment has strengthened the resilience of the equity market. In 2025, the balance of margin trading and securities lending exceeded RMB 2.5 trillion, and the average daily trading volume of A-shares remained around RMB 1.7 trillion, providing solid support for brokerage, margin trading, and investment businesses.

**Hualong Securities Believes:**

Amid expectations of a slow bull market, the proportion of equity asset allocation by brokerages continues to rise. Combined with the growth of index-based investments and the enhanced distribution capacity of public funds, wealth management business is facing structural opportunities. The regulatory focus is shifting from scale expansion to efficiency and return assessment, eliminating revenue bonus items and strengthening ROE orientation. This forces the industry to optimize resource allocation and improve capital utilization efficiency, ushering in a period of development opportunities for brokerages.