Overview of the "Alpha Wolf" Limit-Up Trading Strategy

-

The "Alpha Wolf" typically buys stocks between 9:30 AM and 10:00 AM. This period is when the market digests overnight news, providing clues about the stock's strength for the day.

-

After a high opening, the stock shows two or more consecutive upward surges. Such strong movements indicate heavy capital inflow, with morning trading volume significantly exceeding the previous day's.

-

The ideal entry point is during the second pullback, just as the third upward wave begins.

-

Notably, if the intraday moving average resists breakthrough, the point where the price touches this average often marks the start of the next rally. Such stocks have high limit-up potential.

Operational Style

-

Ultra-short-term trading, specializing in capturing daily limit-up stocks.

-

Military-like discipline in execution.

-

Focus solely on leading stocks.

-

Prioritize stocks with heavy capital inflow, which remain strong regardless of market conditions and have the highest limit-up probability.

-

Chase rallies and cut losses, frequently rotating into stronger stocks—buy today, sell tomorrow.

-

Concentrate positions on a single leading stock.

Key Principles

-

Trade only ultra-short-term强势股 for极高成功率.

-

Precision: Never act under uncertainty.

-

Speed: Strike decisively and exit swiftly.

-

Ruthlessness: Cut losses unflinchingly, embracing "less loss is profit."

-

Sell immediately if the stock underperforms intraday to avoid volatility traps.

Stock Selection Criteria

Target stocks with high market liquidity preference:

-

Maintain a watchlist for real-time tracking.

-

Favor companies with strong macro/industry fundamentals, preferably restructuring candidates.

-

Market cap ideally between tens of millions to 3-4 billion, max 20 billion.

-

Trade only sector leaders; avoid laggards.

-

Reject large-caps, highly manipulated stocks, ST shares,高价股, surging stocks, and those with >20% turnover.

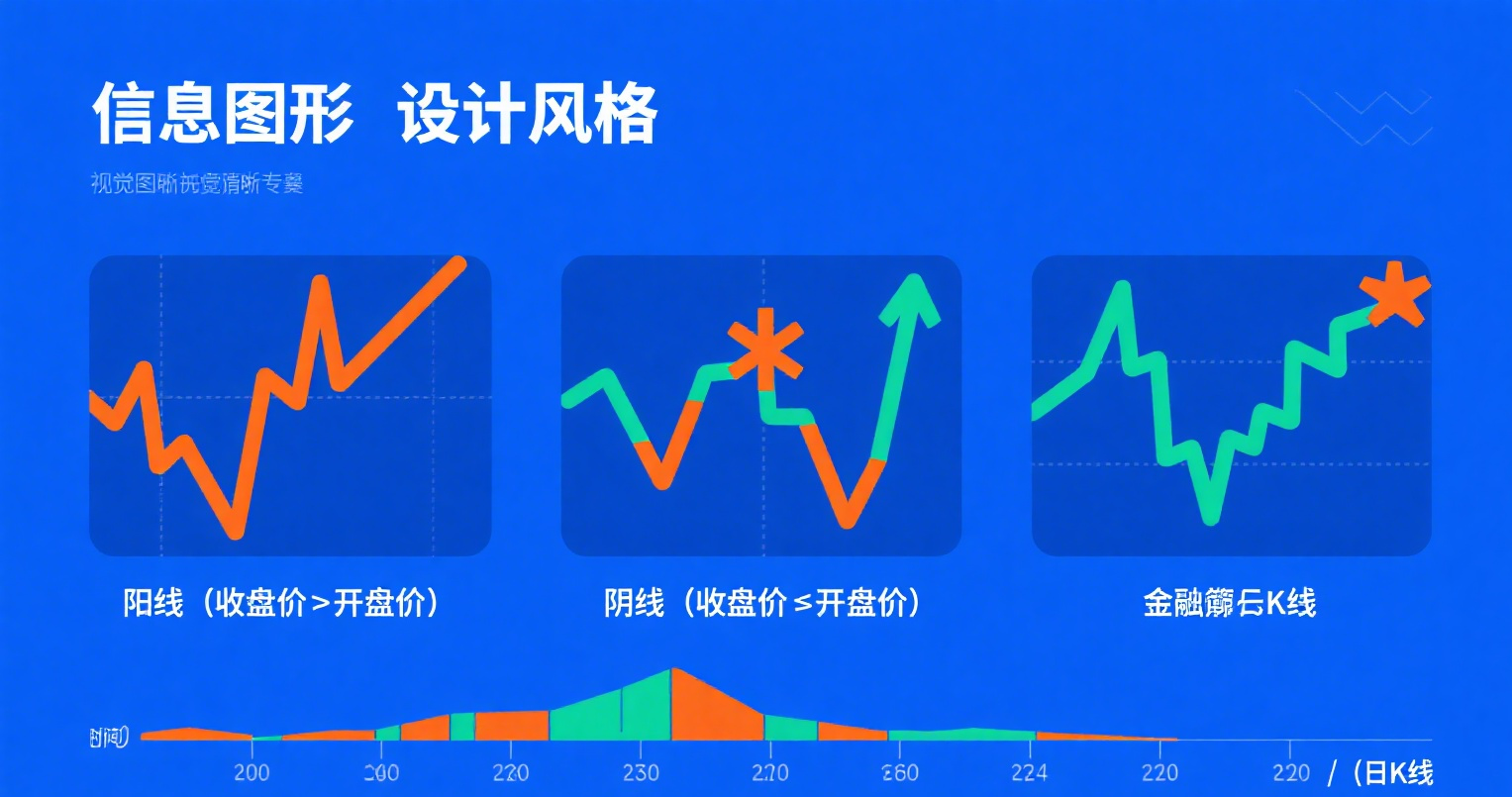

Entry Timing: Weak-to-Strong Transition on Daily K-Line

-

Full low-position adjustment: Confirm price stabilization via K-line—small阴阳 candles with shrinking volume and no new lows for 10 days.

-

Strengthening signs: MACD golden cross above zero轴.

-

Minor rallies on volume, with pullbacks showing lighter volume.

-

When approaching key MAs or resistance zones, a retreat confirmed as洗盘 warrants close monitoring.