What Are the Five Steps of the Stock Selection Method?

-

Volume Ratio

After the market opens, we first check the volume ratio ranking. Any stock with trading volume has the potential to rise at any time. It’s impossible to select a limit-up stock based solely on this criterion. Next, we look at the second factor—the intraday chart. -

Intraday Chart

The second factor is the intraday trend, which should align with our moving average strategy. We analyze it within the intraday chart. The third element is the K-line pattern. -

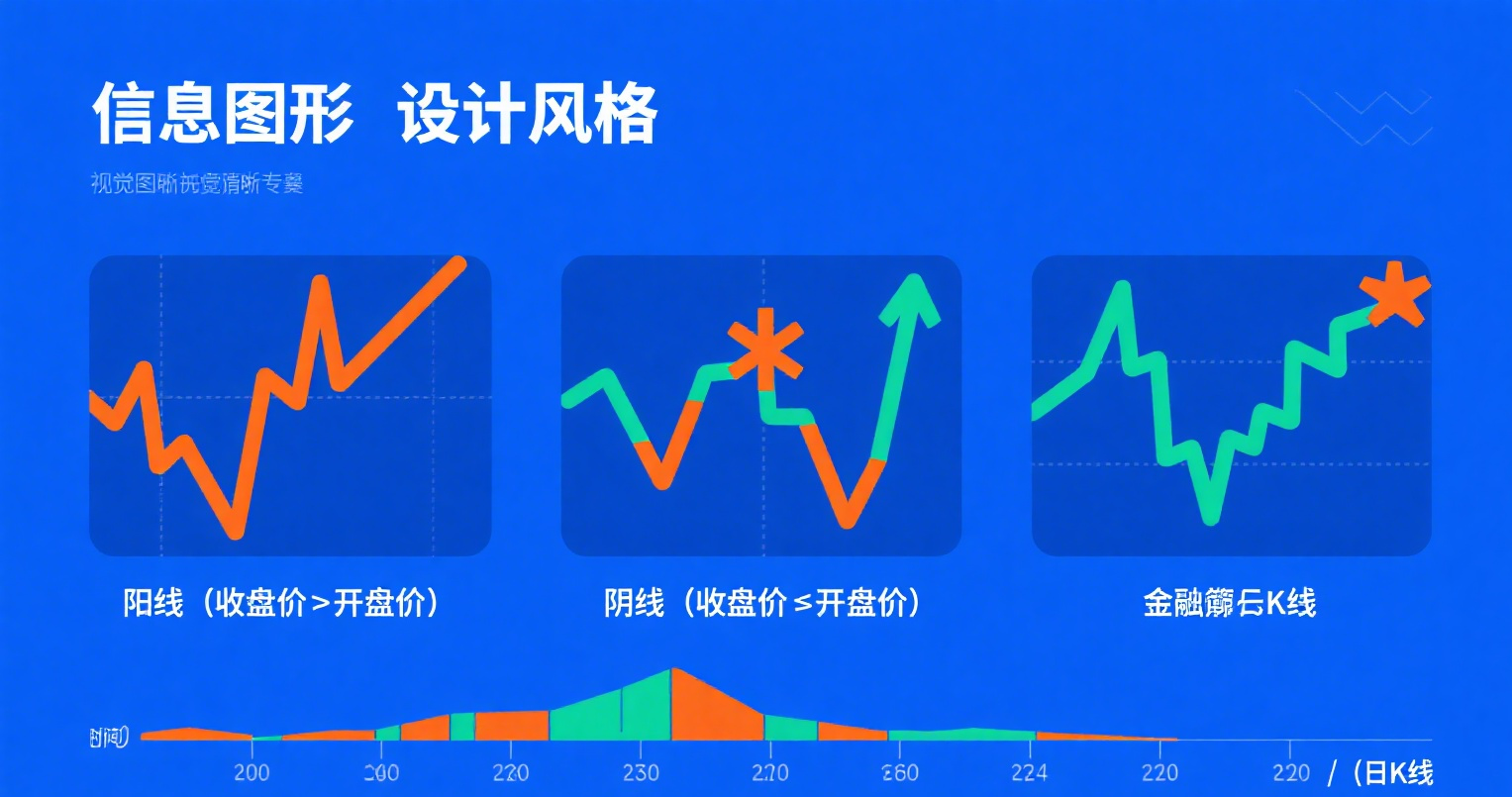

K-Line

The K-line trend should be supported by the middle Bollinger Band or meet other criteria, matching the "Testing the Waters" strategy I wrote about yesterday. Thus, the K-line is our third buying condition. Another rule is not to chase highs. If a stock shows signs of hitting the limit-up at opening and cannot be bought in time, avoid chasing it, as its upside potential is limited. -

Price Increase

If a stock with high volume ratio appears limit-up in early trading, avoid chasing those with over 6% gains—opt for stocks with less than 5% increase to ensure room for further growth. Buying at +6% leaves little profit margin. -

Turnover Rate

Select stocks with a turnover rate above 5%, ideally over 7%. Low-turnover stocks are temporarily disregarded. While limit-ups can still occur, the probability is lower with low turnover.

The five-step method is simple and efficient once mastered, but real-time market trends must also be considered.

Market Outlook & Trading Suggestions

-

If a stock hits the limit-up without significant turnover expansion, it will likely continue rising the next day—hold.

-

If a stock hits the limit-up with high turnover, consider selling during the next day’s rally (if gains exceed 6%) for short-term profits.

-

If a stock doesn’t limit up and turnover remains low, observe the next day’s opening volume ratio. If it fits the five-step method, hold; otherwise, switch stocks.

-

If a stock doesn’t limit up but turnover surges, monitor the next day’s volume ratio. If criteria are met, hold; otherwise, sell during a potential +6% rally and reinvest.

Stock trading is not gambling—without skill, losses are inevitable. Surviving this market is tough. There are no bad markets, only bad strategies. Every fluctuation is a capital feast and the best investment opportunity.