In 2008, China introduced its first development plan for the new energy vehicle (NEV) industry. Over the past decade, the country's NEV sector has achieved remarkable success, maintaining its position as the global leader in NEV production and sales for nine consecutive years.

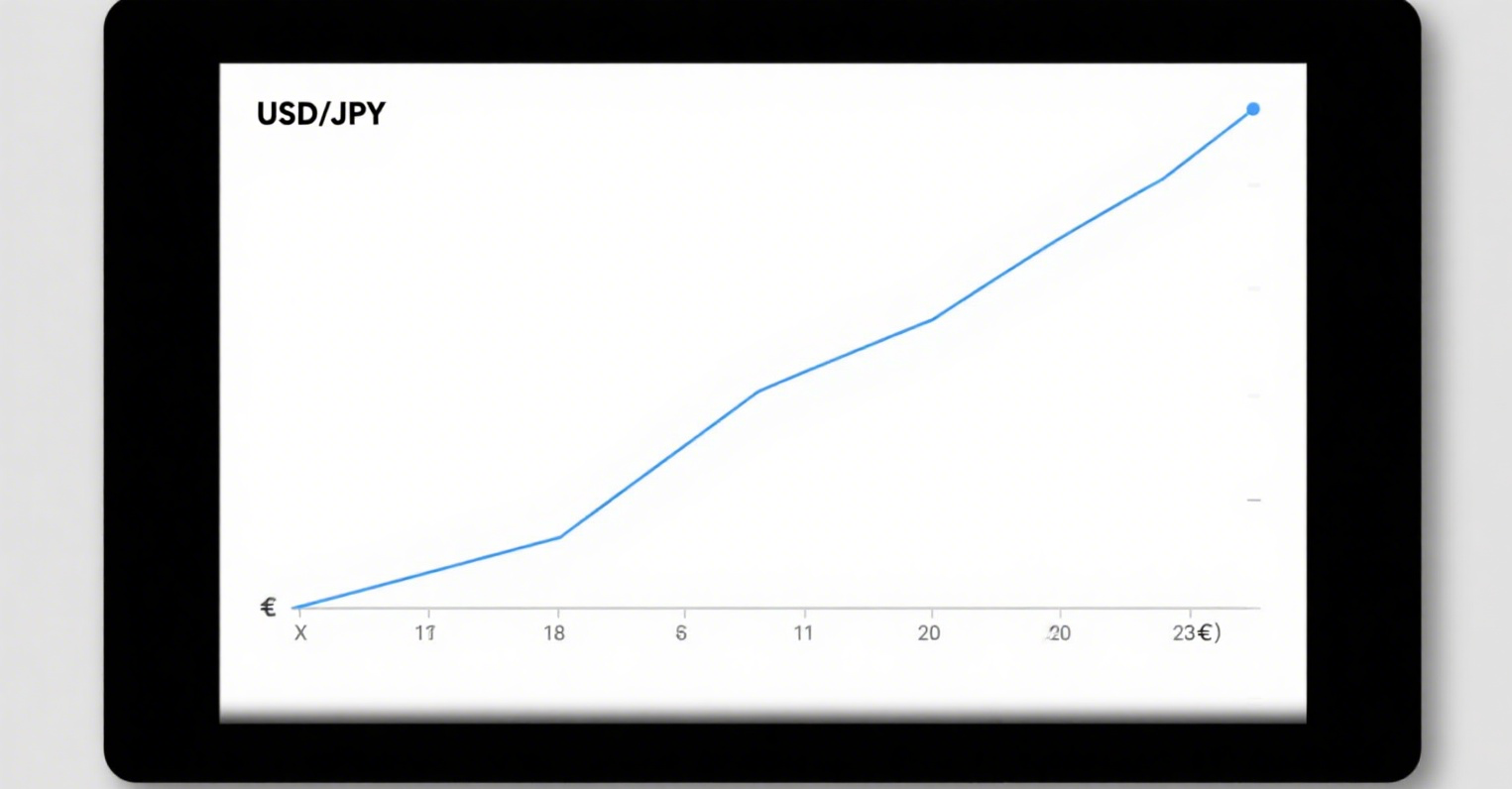

According to the latest data from the China Association of Automobile Manufacturers (CAAM), China's NEV industry has continued its strong growth this year. In the first five months, NEV production and sales reached 3.926 million and 3.895 million units, respectively, representing year-on-year increases of 30.7% and 32.5%. NEVs accounted for 33.9% of total vehicle sales.

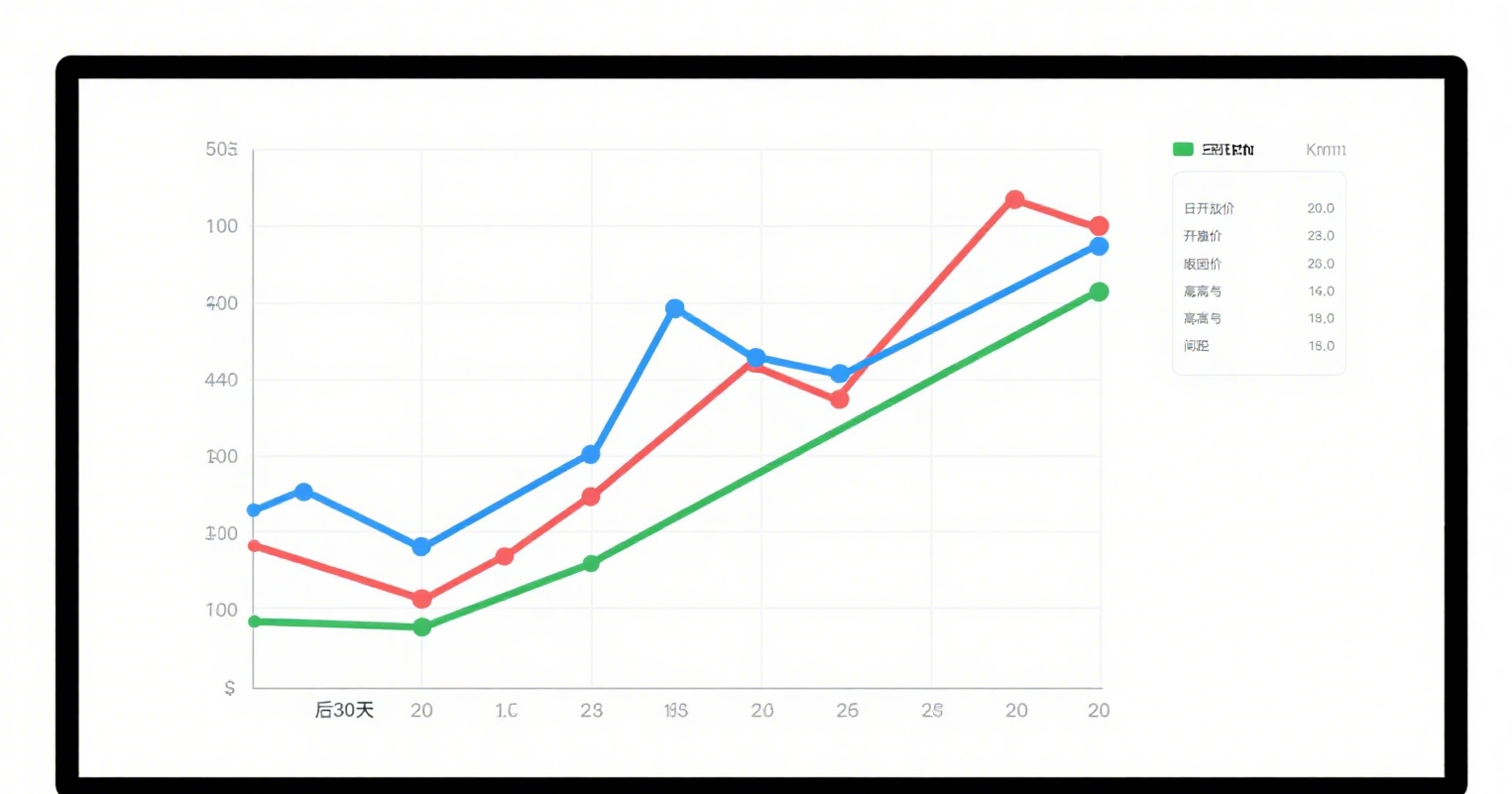

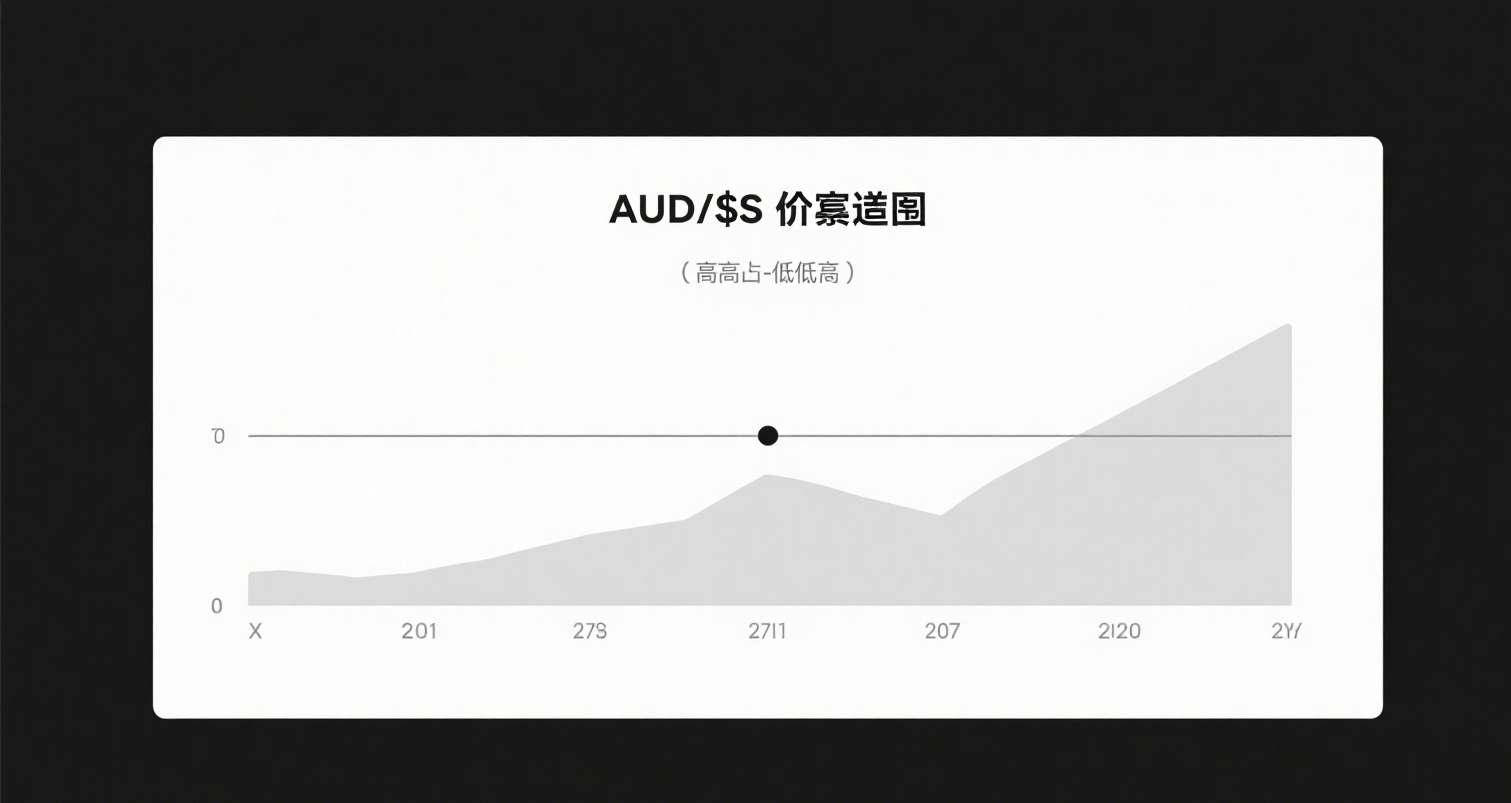

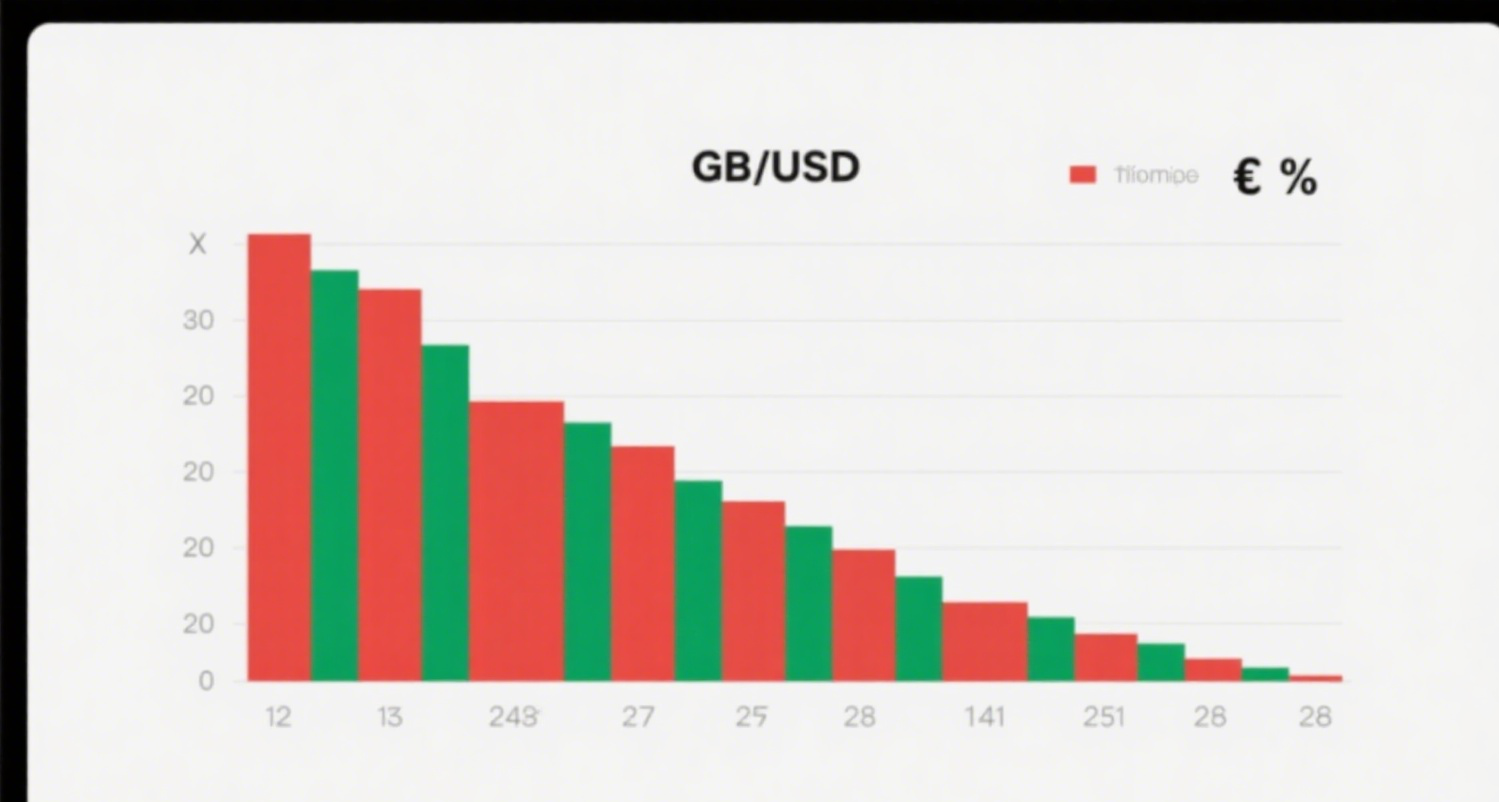

With the rapid development of the NEV industry, a number of globally competitive vehicle manufacturers and component suppliers have emerged, attracting significant market attention for their investment value. Since February, the CSI Auto Parts Theme Index and the CSI Smart Electric Vehicle Index have both performed well, with cumulative gains of 12.9% and 18.6%, respectively, as of June 17.

While both indices focus on the automotive industry, what are the differences between the CSI Auto Parts Theme Index and the CSI Smart Electric Vehicle Index? First, let’s examine the NEV industry chain and then compare the two indices in terms of sector distribution, constituent stocks, and growth prospects.

Deconstructing the NEV Industry Chain

The longer an industry’s chain, the more sectors it can drive and the greater the economic benefits it can generate. As one of China’s strategic emerging industries, the NEV sector involves numerous sub-sectors.

Specifically, the upstream segment consists of basic components, including core parts such as drive motors, electronic control systems, and power batteries; traditional components such as transmission parts, braking parts, steering parts, suspension parts, electrical instrument parts, and body and accessories; and smart components such as sensors, chips, software algorithms, and intelligent connectivity.

The midstream segment is vehicle manufacturing, where automakers assemble components and parts sourced from the upstream chain into finished vehicles. Current offerings mainly include battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs).

The downstream segment covers automotive services, including charging and battery-swapping services, battery recycling, and aftermarket services.

Now, let’s focus on three key areas: battery technology, autonomous driving, and software systems.

Batteries are the power source of NEVs, and their performance directly impacts vehicle range and cost. Autonomous driving involves advanced sensors and algorithms and has become a critical competitive edge for automakers. Software systems not only control vehicle operations but also provide entertainment, navigation, and other services, significantly impacting user experience.