How to Read an Individual Stock's Intraday Chart

-

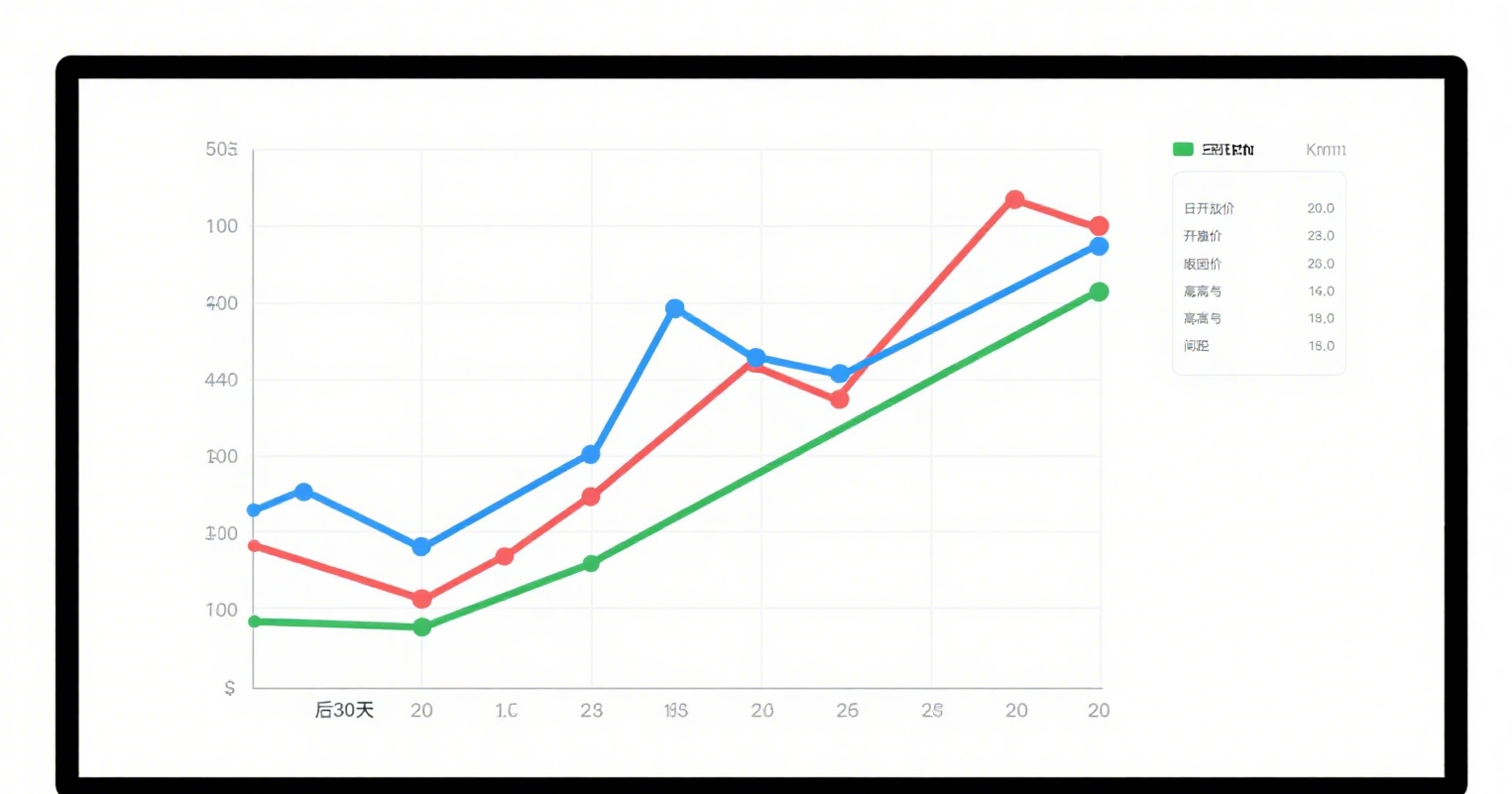

Price Line (White Curve)

-

Shows the stock's real-time transaction prices.

-

-

Average Price Line (Yellow Curve)

-

Reflects the average trading price from market open to the current time, similar to a moving average.

-

-

Sell Order Queue

-

"Sell 1, Sell 2, Sell 3" display pending sell orders in sequence.

-

Prioritized by:

-

Lower selling prices first.

-

Earlier orders if prices are equal.

-

-

Example: "Sell1 18.95" means the best ask price is ¥18.95 with 50 lots (5,000 shares) waiting to sell.

-

-

Buy Order Queue

-

"Buy 1, Buy 2, Buy 3" show pending buy orders.

-

Prioritized by:

-

Higher bid prices first.

-

Earlier orders if prices match.

-

-

Example: "Buy1 18.94" indicates the highest bid is ¥18.94 with 2,547 lots (254,700 shares) queued.

-

-

Price & Volume Display

-

Average Price: Mean transaction price since opening (Total Turnover / Volume). Closing average = daily average.

-

Open: First trade price of the day. If no trades in 30 minutes, the previous close is used.

-

High: Highest price reached during the session.

-

Low: Lowest price so far.

-

Volume Ratio: Relative volume indicator:

Volume Ratio = Current Lots ÷ (5-day Avg Lots / 240) ÷ Minutes Since Open

-

Ratio > 1: Volume expanding; < 1: Volume shrinking. Must correlate with price trends.

-

-

Last Trade: Latest executed price. The closing price is the final trade.

-

Change: Absolute price change (in yuan). ▲ = rise; ▼ = fall.

-

Change %: Percentage gain/loss (red = up; green = down).

-

Total Volume: Cumulative shares traded (1 lot = 100 shares).

-

Current Lots: Size of the latest trade. The right-bottom panel details each transaction:

-

Red arrow ↑: Executed at ask price.

-

Green arrow ↓: Executed at bid price.

-

-