What Are the Functions of the Foreign Exchange Market?

What are the functions of the foreign exchange market? The primary functions of the foreign exchange market are reflected in three aspects: first, facilitating the international transfer of purchasing power; second, providing financing; and third, offering a market mechanism for foreign exchange hedging and speculation.

-

Facilitating the International Transfer of Purchasing Power

International trade and cross-border financing involve at least two currencies, and different currencies represent purchasing power in different countries. This necessitates the exchange of one currency for another to settle debts and credits, enabling transactions to be completed. Such exchanges are conducted in the foreign exchange market. The foreign exchange market provides the economic mechanism that allows these purchasing power transfers to proceed smoothly, connecting potential sellers and buyers of foreign exchange. When exchange rate fluctuations balance supply and demand, all potential buying and selling intentions are satisfied, and the market reaches equilibrium. Thus, the foreign exchange market serves as a mechanism for the international transfer of purchasing power. Additionally, advanced communication tools have integrated foreign exchange markets worldwide, enabling currency conversion and fund transfers to be completed quickly, making such transfers efficient and convenient. -

Providing Financing

The foreign exchange market offers financing convenience for international traders. Foreign exchange deposit and loan services pool idle funds from various countries, allowing for the redistribution of surplus and deficit funds and accelerating capital turnover. The foreign exchange market ensures the smooth progress of international trade—when an importer lacks sufficient cash to pay for goods, the exporter may issue a bill of exchange allowing deferred payment, while selling the bill at a discount to recover payment. The financing function of the foreign exchange market also facilitates international lending and investment activities. A significant portion of U.S. Treasury bills and government bonds are purchased and held by foreign institutions and enterprises, a scenario unimaginable without the foreign exchange market. -

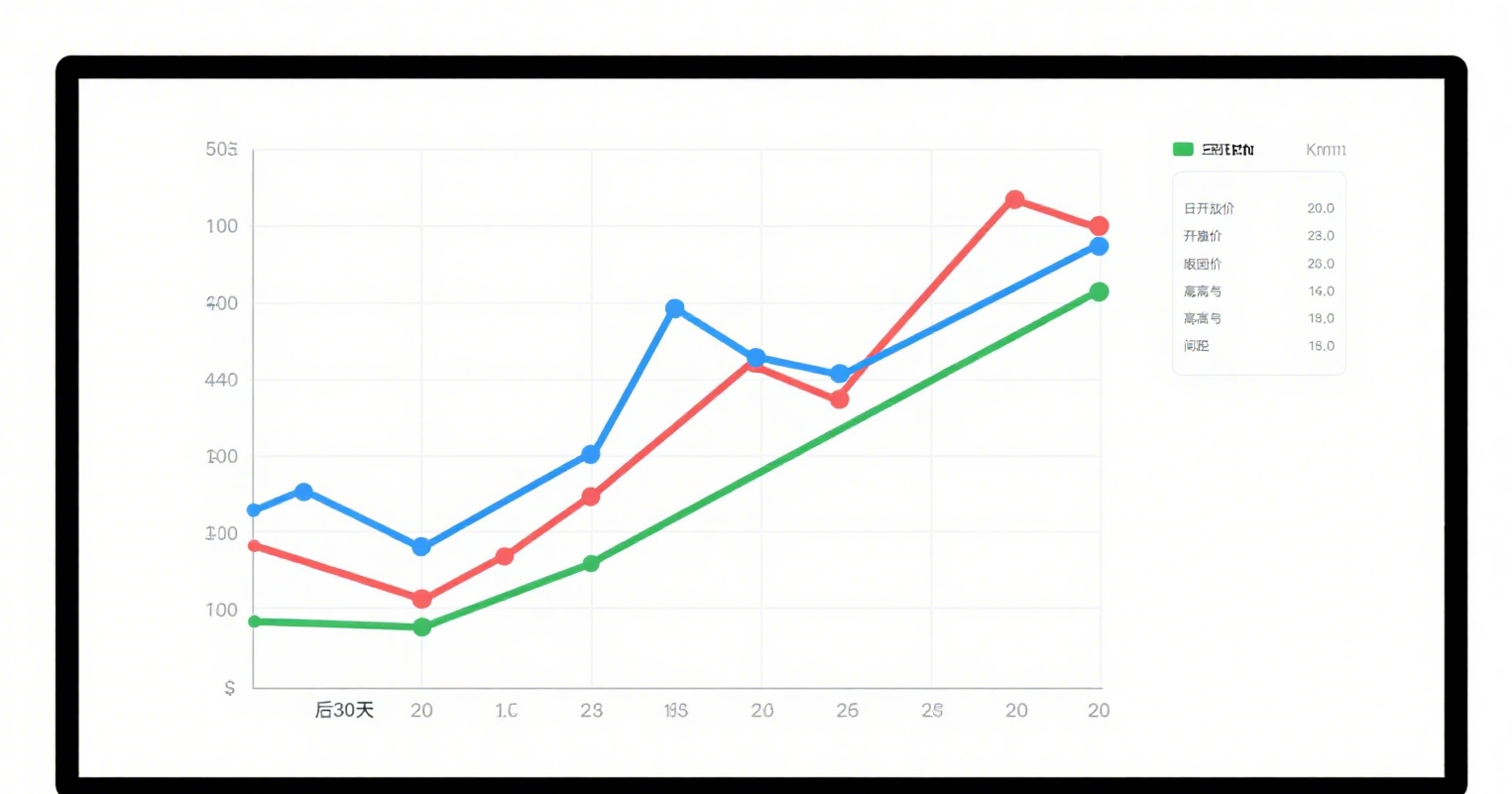

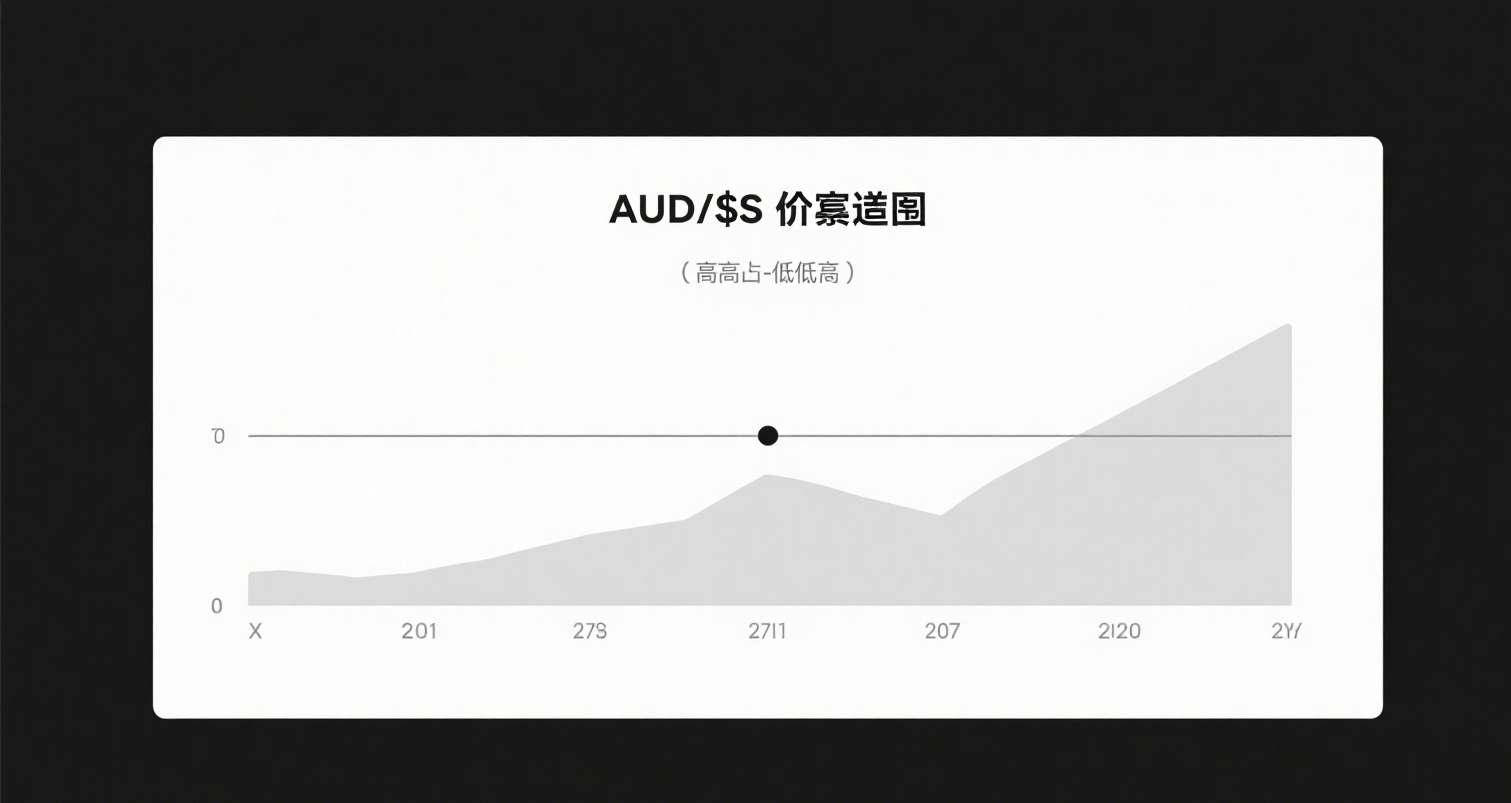

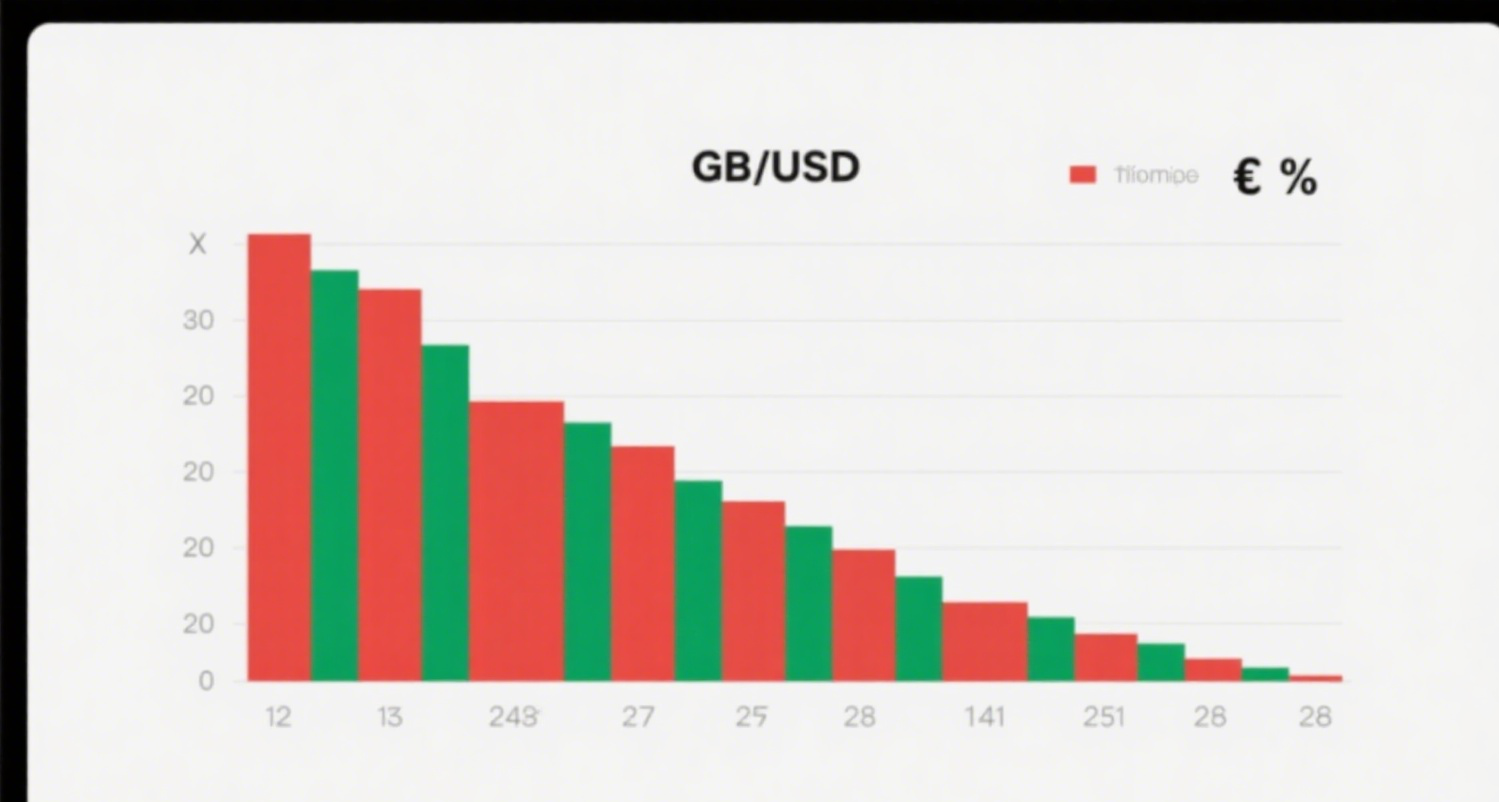

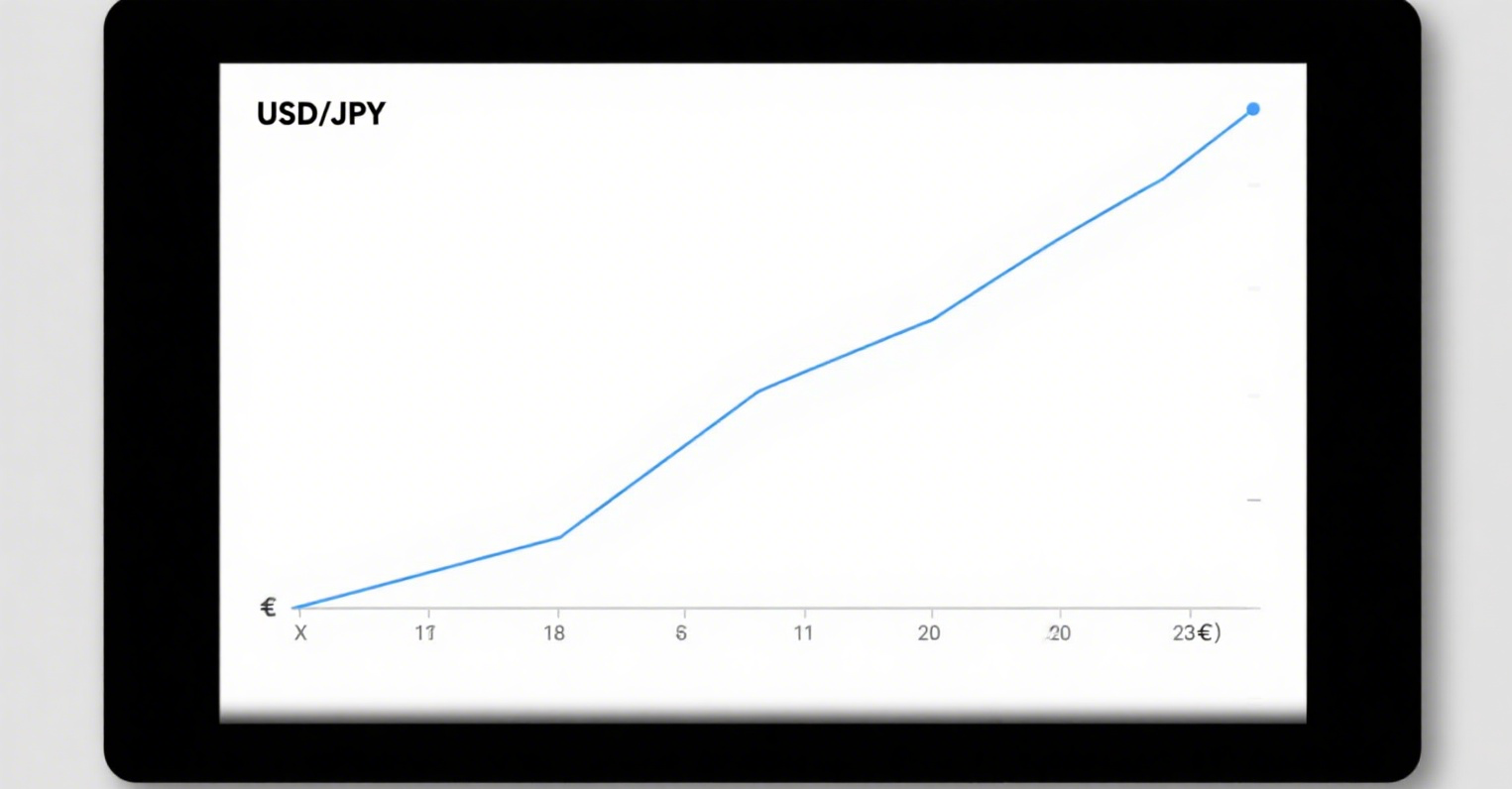

Providing Mechanisms for Hedging and Speculation

In international transactions settled in foreign currencies, both parties face exchange rate risks. Due to differing risk assessments and preferences, some participants prefer to incur costs to mitigate risks, while others are willing to bear risks to achieve expected profits. This gives rise to two distinct behaviors: hedging and speculation. Under the gold standard and fixed exchange rate systems, exchange rates were relatively stable, eliminating the need or possibility for hedging and speculation. However, under floating exchange rates, the foreign exchange market has further developed, providing a platform for hedgers to avoid risks and for speculators to take risks for potential profits.