What Are the Characteristics of the Foreign Exchange Market?

The foreign exchange market refers to a trading venue where international currency exchange occurs, balancing the supply and demand of foreign currencies. Its function is to trade currency products, i.e., the currencies of different countries. The growing popularity of the forex market among investors worldwide is closely tied to its unique characteristics. So, what are the key features of the forex market?

-

A Market Without a Centralized Location

The financial industries in Western countries, such as those in Europe, generally operate under two systems: centralized trading (exchange-based) and decentralized over-the-counter (OTC) networks. Stock trading occurs through exchanges like the New York Stock Exchange, London Stock Exchange, and Tokyo Stock Exchange, which serve as the primary trading venues for U.S., U.K., and Japanese stocks, respectively. These centralized markets have unified rules for pricing, trading hours, and settlement procedures, along with industry associations and codes of conduct. Investors trade through brokerage firms, making it a "market with a physical location."In contrast, forex trading operates through a decentralized OTC network without a centralized exchange. Unlike stocks, forex has no single trading floor. However, the forex network is global, forming an "organization without an organization." The market is connected through widely accepted practices and advanced information systems, and platform providers are not members of any formal organization but must earn industry trust and recognition. This decentralized structure is why forex is called a "market without a central location."

The global forex market handles trillions of dollars in daily transactions. Such enormous capital flows are settled and transferred without centralized venues, clearing systems, or government oversight.

-

24-Hour Continuous Operation

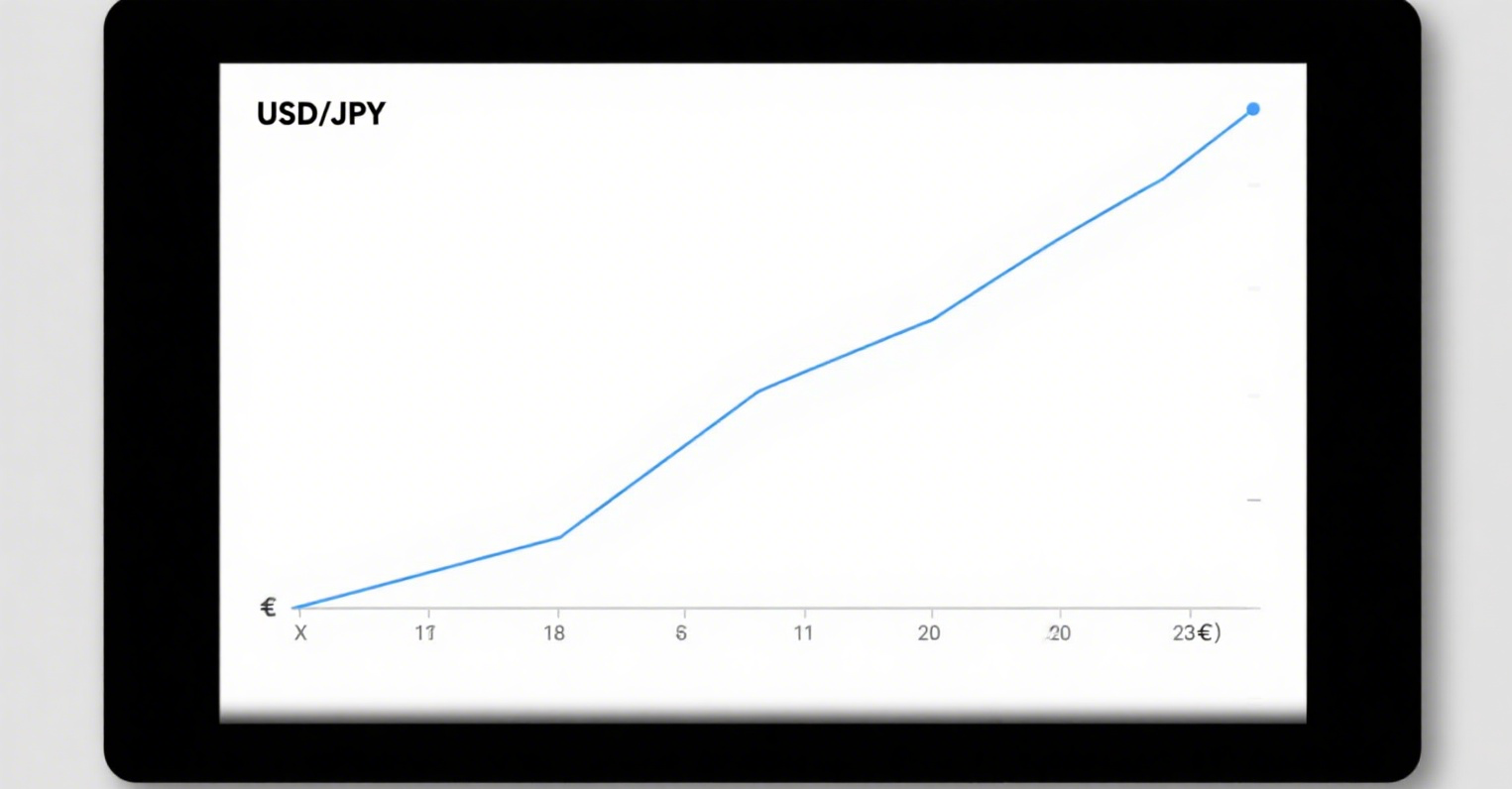

Due to the geographical distribution of global financial centers, the Asian, European, and American markets operate in shifts, creating a 24-hour non-stop forex market. The trading day begins with New York opening at 8:30 AM (EST), followed by Chicago at 9:30 AM, San Francisco at 10:30 AM, Sydney at 6:30 PM, Tokyo at 7:30 PM, Hong Kong and Singapore at 8:30 PM, Frankfurt at 2:30 AM, and London at 3:30 AM.This uninterrupted operation makes forex a round-the-clock market, closing only on weekends and major holidays. This continuous cycle provides investors with an ideal trading environment free from time and space constraints, allowing them to seize the best opportunities.

For example, if an investor buys Japanese yen in the New York morning session and the yen rises when Hong Kong opens in the evening, the investor can sell in Hong Kong—regardless of their physical location. Thus, the forex market is truly a barrier-free market in terms of time and space.

-

Zero-Sum Game

In the stock market, if a stock or the entire market rises or falls, the value of that stock or the overall market also changes. For instance, if Nippon Steel’s share price drops from ¥800 to ¥400, the total value of its shares is halved.