How Is Forex Spread Calculated?

How is the forex spread calculated? Let’s break it down.

A pip (percentage in point) is the smallest price movement in forex, typically 0.0001 for most currency pairs (except JPY pairs, where it’s 0.01). Traders use pips to calculate profit/loss and manage risk.

1. What Is a Pip?

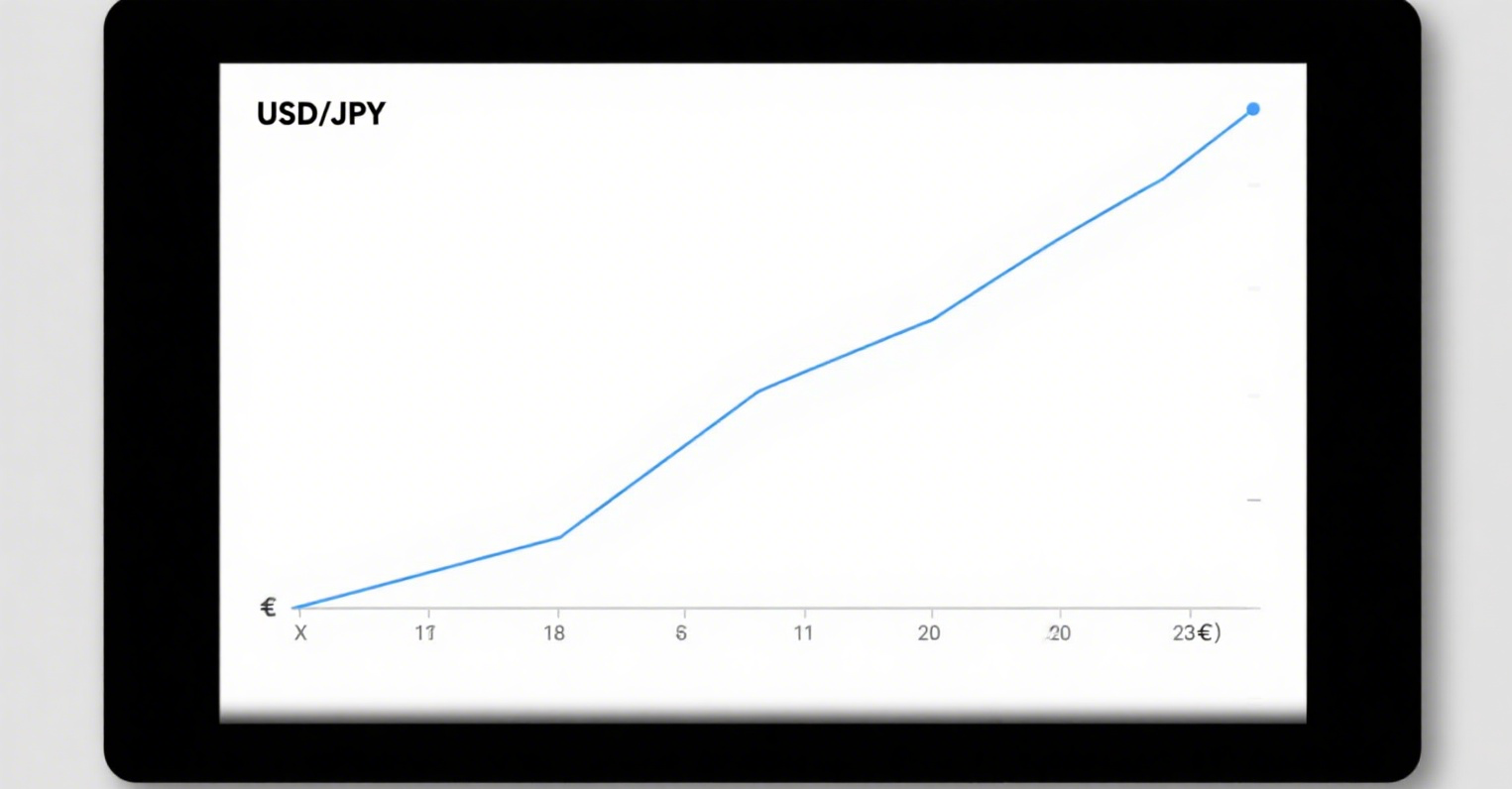

A pip is the smallest price change in forex. For most pairs (e.g., EUR/USD), 1 pip = 0.0001. For JPY pairs (e.g., USD/JPY), 1 pip = 0.01.

Many trading platforms now quote prices to 1/10th of a pip (e.g., 0.00001), narrowing spreads. This benefits traders, as spreads affect costs and profits.

2. Pip Calculation

As mentioned:

-

EUR/USD:

-

Falls from 1.1460 to 1.1400 = 60 pips down.

-

Rises from 1.1460 to 1.1500 = 40 pips up.

-

-

USD/JPY:

-

Rises from 112.50 to 112.98 = 48 pips up.

-

Pips measure profit/loss. Forex trades in lots or contracts, with definitions varying by platform. For IG:

-

1 mini lot (0.1 lot) = 10,000 units (amplifying price moves by 10,000x).

-

1 pip = 1 unit (i.e., 0.0001 × 10,000 = 1).

-

If your account is USD-denominated, 1 pip ≈ $1.

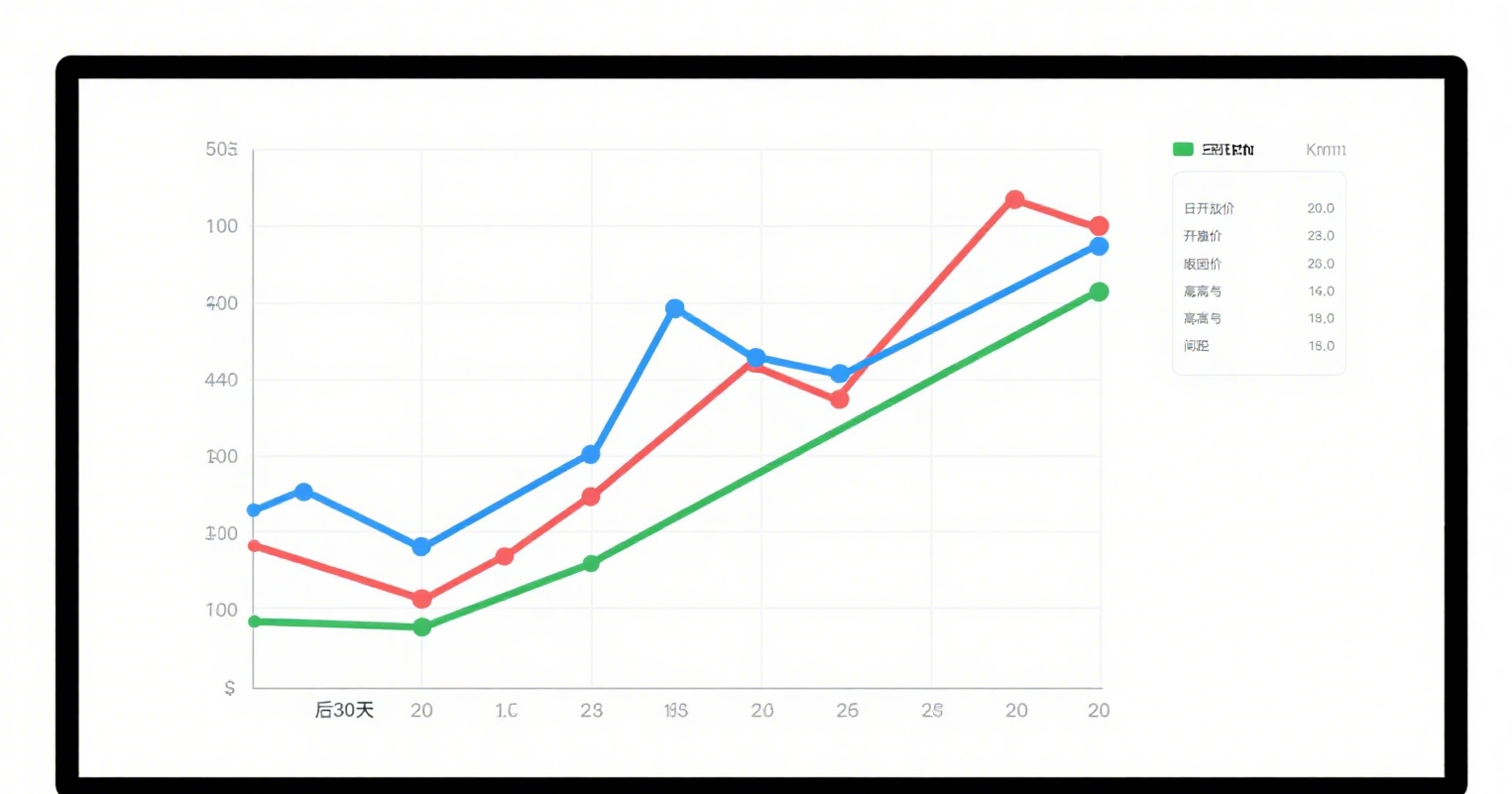

3. Example: EUR/USD Trade

USD Account:

-

You sell 2 mini lots (0.2 lots) at 1.1460.

-

Price drops to 1.1360, gaining 100 pips/lot (total 200 pips).

-

Since 1 pip ≈ $1, profit = $200.

EUR Account:

-

At exit, 1 EUR = 1.1360 USD, so 1 USD = 0.8803 EUR.

-

Thus, 1 pip ≈ €0.8803, total profit = €176.06 (200 × 0.8803).

Conclusion

Understanding pips helps manage risk/reward ratios. Since lot sizes vary by platform, practice with a demo account before live trading.