How is the foreign exchange market anticipated?

If the trend analysis is correct, then foreign exchange trading will be successful. In other words, to predict future exchange rate trends, one must understand how to analyze and anticipate the foreign exchange market. Below, we will introduce how to analyze and anticipate the foreign exchange market.

-

Anticipating the Foreign Exchange Market

Under the floating exchange rate system, the trend of any foreign exchange can only be divided into three forms:

Rising, falling, or sideways. In the foreign exchange market, sideways trends account for about 70%~80% of annual trading days, while the remaining 20%~30% are bullish or bearish trends.

In foreign exchange trading, if investors want to profit, they must carefully analyze and predict market trends. Generally, foreign exchange investors anticipate future prices and then execute buying transactions and operations based on these expectations.

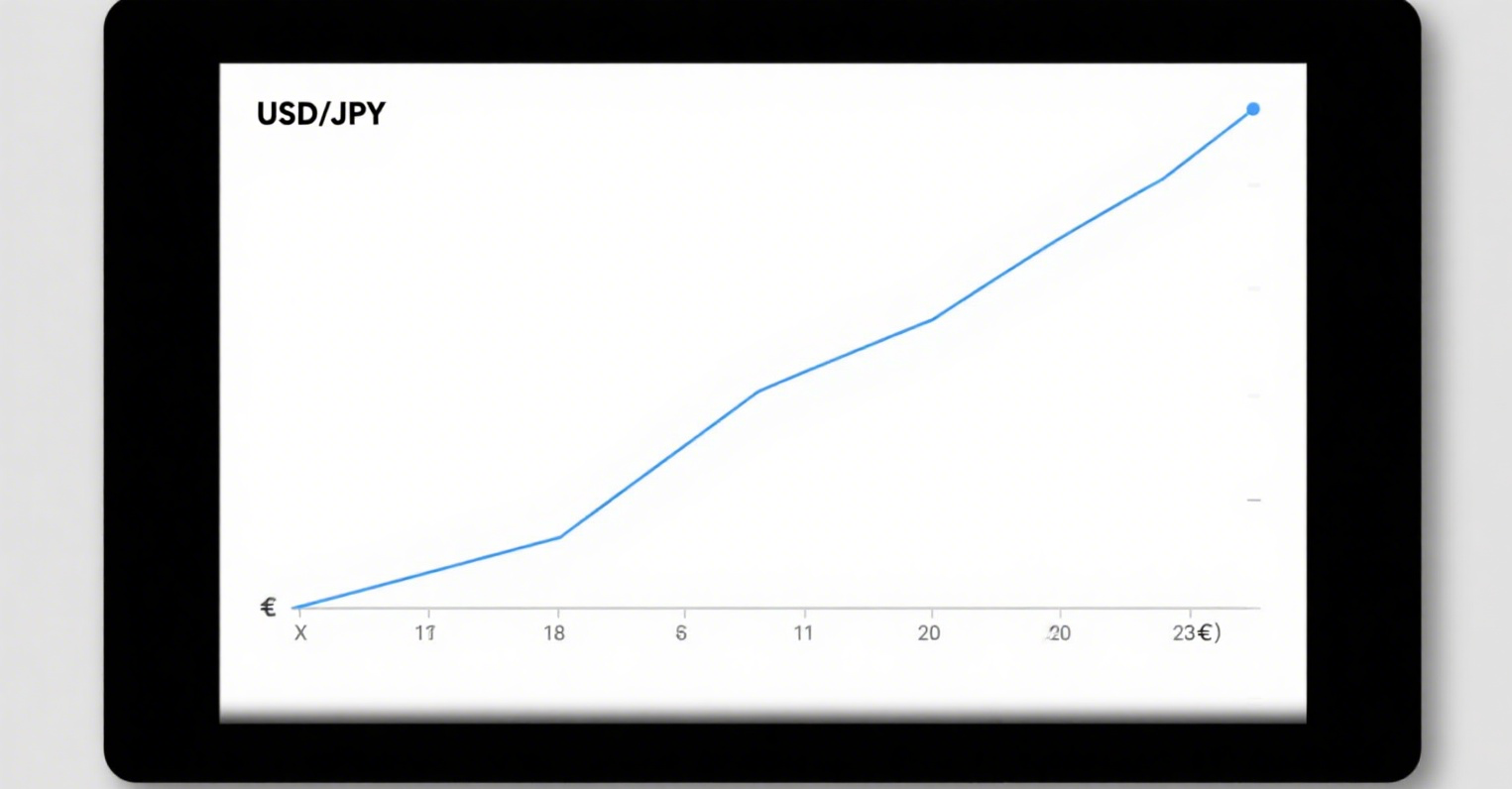

For example, from January to March 2013, the Bank of Japan's intervention in the market was announced firmly and clearly, leading to a significant decline in the yen. According to Hong Kong's Wen Wei Po citing foreign reports, after Japanese Prime Minister Shinzo Abe took office, he vowed to lower the yen's exchange rate. Not only did he succeed in reducing the yen's value by 20% in just four months, but he also helped long-underperforming "macro hedge funds" make a comeback.

These funds took advantage of the yen's sharp decline, aggressively selling yen and sparking the so-called "Abenomics trade" trend. Among them, the famous speculator George Soros reportedly netted nearly $1 billion from shorting the yen between November 2012 and the end of February 2013.

The medium- to long-term trends in the foreign exchange market can generally be identified.

The current trend is either rising or falling. The difficulty lies in understanding what causes such significant trends.

The reason is very simple: global hot money follows profitability.

The stability and growth potential of a country's stock market, bonds, and real estate are the dominant factors guiding the direction of trillions of dollars worldwide.

There are three main factors affecting the stability and growth potential of these assets:

(1) A country's relative real interest rate, which is the nominal interest rate minus the inflation rate.

(2) A country's money supply. In other words, producing too much currency makes it less valuable.

(3) The foundation and cycle of a country's economic and financial system. These are the primary factors determining the direction of international hot money.

Fundamental analysts believe that the strength of a currency reflects the health of a country's economy. Although its strength may be temporarily affected by non-economic factors, causing fluctuations or trends contrary to economic fundamentals, in the long run, its value will eventually align with the economic situation.

As for how to measure the health of a country's economy, a relative comparison approach must be adopted.

Using fundamental analysis to predict medium- to long-term currency trends—such as the next 6 months, 1 year, or 2 years—is still appropriate. However, since the gold standard was abolished and the floating exchange rate system became internationally prevalent, factors beyond fundamental analysis have also influenced currency prices to varying degrees.

Speculators buy and sell in international markets every second, and large transactions can also affect foreign exchange trends.