In June 2015, the birth of Ethereum broke the misconception that blockchain could only be applied to digital currencies. However, early Ethereum had a major flaw—its first version was unstable, making many of the concepts mentioned in the Ethereum Whitepaper impossible to implement.

It wasn’t until May 14, 2016, with the official release of Ethereum’s second phase, "Homestead," that the stability issues were fully resolved. This attracted a large number of developers to build Ethereum’s smart contract ecosystem. From then on, public chains represented by Ethereum gradually took center stage.

Additionally, on July 20 of that year, Bitcoin underwent its second halving, reducing mining rewards from 25 BTC to 12.5 BTC. The largest bull market in Bitcoin’s history arrived as expected. As prices surged, mainstream institutions finally recognized the power of blockchain, and a quiet revolution began.

By 2017, Ethereum’s ecosystem had begun to show results. Thousands of developers designed products and projects based on Ethereum’s underlying infrastructure, with decentralized applications spanning crowdfunding, IoT, gambling, social networks, insurance, data storage, wallets, decentralized exchanges, and more. People realized that blockchain wasn’t limited to digital currencies—it could be applied across industries. The potential of blockchain technology was vast enough to disrupt the existing internet world.

As a result, major international banks began experimenting with developing smart contracts on Ethereum’s public chain to address trust issues in financial services.

Domestically, China’s "Big Four" state-owned banks (ICBC, ABC, BOC, and CCB) partnered with fintech companies to establish labs for blockchain application development. Joint-stock banks like China Merchants Bank and Minsheng Bank went further, exploring blockchain integration in cross-border payments, settlements, and bills.

Tech giants like Tencent, Baidu, and Alibaba also began laying out blockchain-related businesses. Ant Financial, Baidu Financial, and JD Finance experimented with blockchain in supply chain finance and asset securitization. Meanwhile, traditional blockchain players launched prominent public chains like NEO and Qtum, hoping to surpass Ethereum and usher in the era of "Blockchain 3.0."

For a time, mainstream tech media buzzed with discussions about blockchain, hoping it would revolutionize the internet, create a truly decentralized network, and give rise to the next BAT-level company.

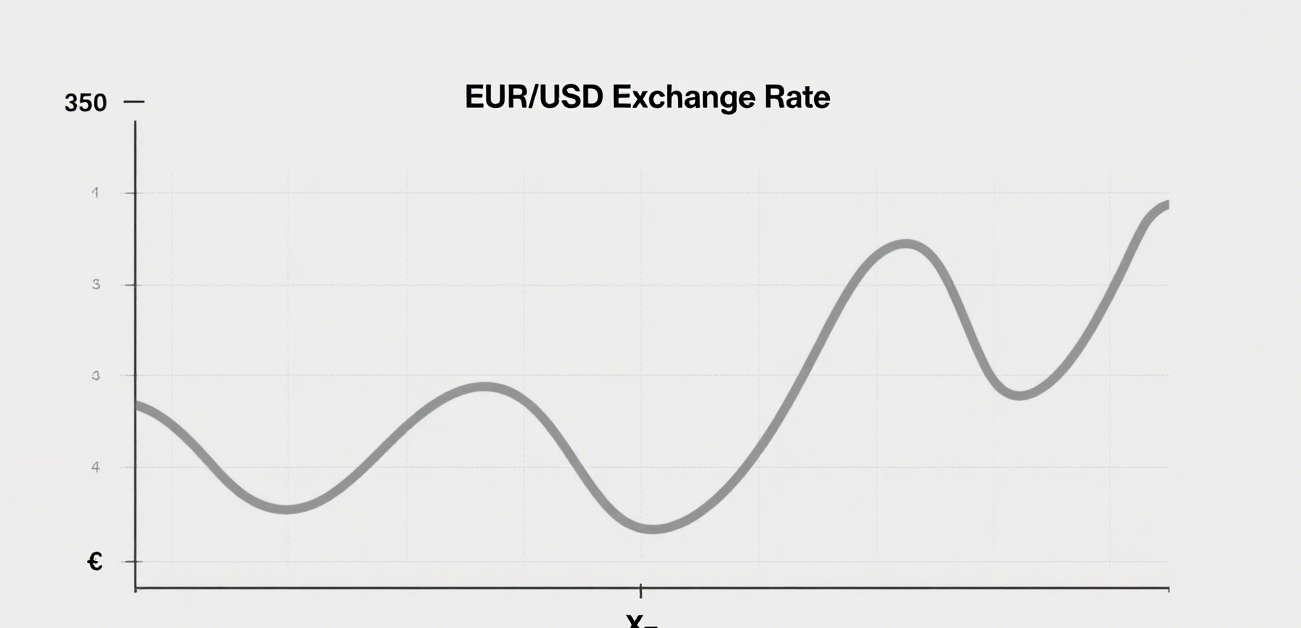

By the end of 2017, the revolution peaked—Bitcoin’s market cap exceeded 2 trillion RMB, reaching nearly $20,000 per coin.

In January 2018, Xu Xiaoping, founder of ZhenFund, remarked in an internal group: "The blockchain revolution has arrived. It is a monumental technological revolution—those who embrace it will thrive, those who resist will perish. Its disruption of tradition will be even more rapid and thorough than that of the internet or mobile internet."

But just like the internet in 2000, great innovations must go through a cycle of "rise—bubble—deflation—implementation—prosperity," and blockchain is no exception.