Digital currencies in the current market can be divided into two categories. The first category is represented by central bank digital currencies (CBDCs) that various countries are preparing to issue, such as China’s Digital Currency Electronic Payment (DC/EP). These digital currencies are legal tender and can truly function as money. The second category consists of early digital currencies like Bitcoin and Ethereum.

Let’s first discuss the first category. Some might ask: How is this type of digital currency different from the electronic cash we commonly use, such as Alipay or online banking? From a practical usage perspective, there is no difference—it is essentially legal tender. However, the underlying operational logic of the two is fundamentally different. Digital currencies employ new technologies like blockchain, which significantly alter the payment processes and settlement mechanisms at their core.

When we use electronic cash like Alipay or WeChat Pay, transactions still rely on traditional commercial banks for settlement through fund transfers. If network or other issues arise, it can cause inconvenience. In contrast, central bank digital currencies are settled through a large central bank system, enabling value transfer even without traditional bank accounts. In other words, they are as liquid as physical cash and as convenient as electronic cash.

Moreover, because central bank digital currencies utilize blockchain technology, they also feature immutability and traceability. This gives them unique advantages in tracking transactions and combating money laundering—capabilities that traditional electronic cash lacks.

Now, let’s turn to the second category: traditional digital currencies like Bitcoin and Ethereum. These were among the earliest digital currencies to emerge. Although the term "currency" is in their name, they are not true legal tender because they are not issued by any nation and thus lack public trust.

In China, such digital currencies are classified as "commercial circle currencies," meaning they have their own unique use cases and serve as a medium of exchange within specific scenarios. For example, Bitcoin can be used as a payment tool on certain platforms for cross-border transactions or purchasing online services abroad. Similarly, Ether (ETH) functions as a payment method on the Ethereum smart contract platform, used to buy "gas" that fuels smart contract execution.

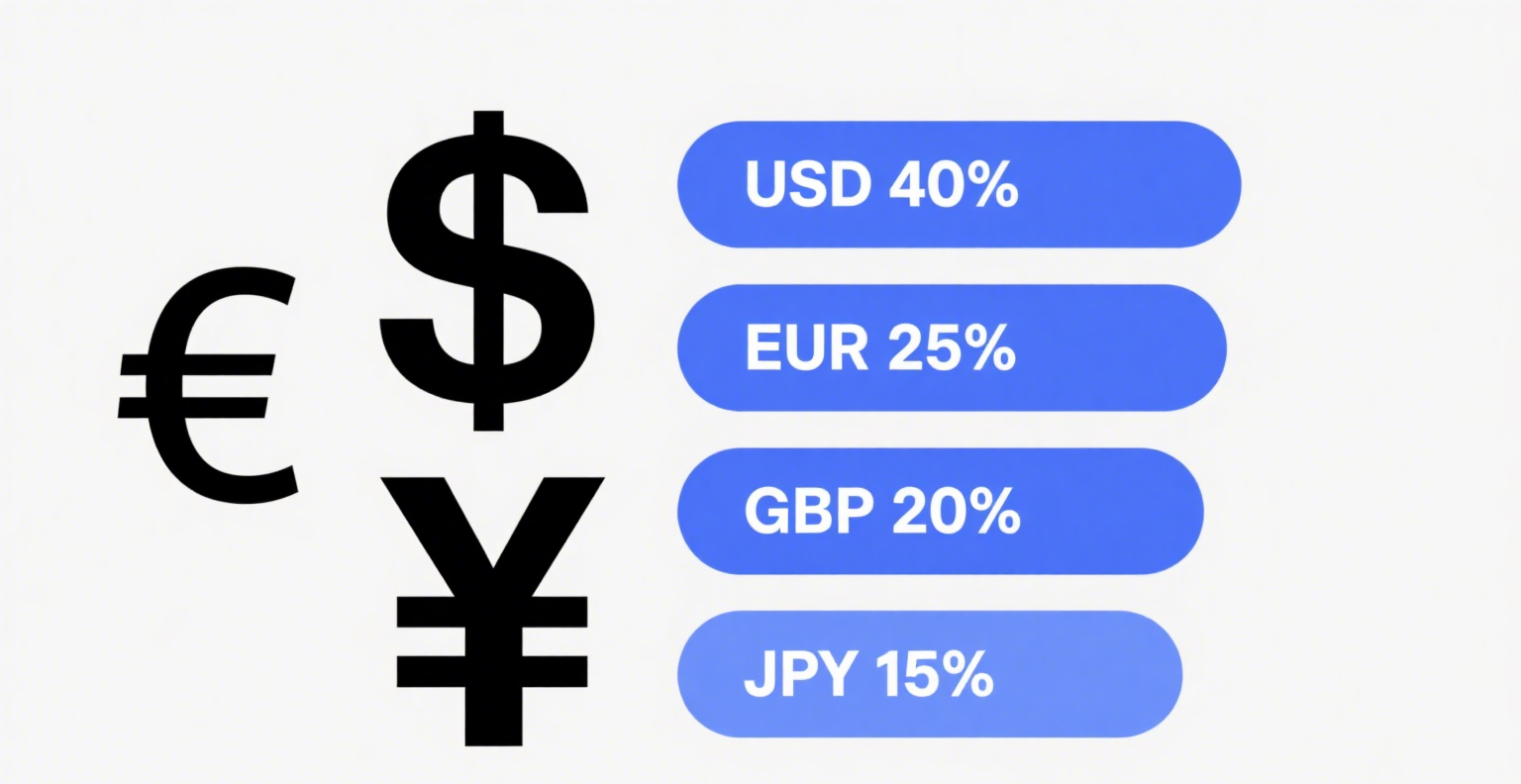

Some countries, such as the United States, Japan, and South Korea, classify these digital currencies as investment assets, akin to gold or stocks, due to their investment value.

Additionally, because of blockchain’s decentralized nature, these digital currencies have no true issuing authority. Some are even beyond the control of their founding teams, making them more decentralized. They rely on cryptographic techniques, smart contracts, and other blockchain technologies to resolve trust issues, allowing anyone to participate, reach consensus, and circulate within a specific community.

In summary, digital currencies can solve many real-world problems, such as cross-border payments and decentralized financial services, offering genuine utility. Currently, China is accelerating the development of its central bank digital currency, and it is believed that soon, this legal digital currency will be launched, gradually integrating into our daily lives and becoming an essential financial tool.