In mid-March last year, the State Council issued the "Action Plan for Promoting Large-Scale Equipment Renewal and Consumer Goods Replacement" (referred to as the Plan), focusing on four major actions: equipment renewal, consumer goods replacement, recycling, and standards upgrading. It covers key industries such as municipal infrastructure and transportation, with a broad scope of impact. What kind of influence will such an important policy have on the capital market? Let’s take a look today.

What’s New About "Renewal" and "Replacement"?

Compared to previous rounds of "renewal and replacement" plans, this action plan is set at a "higher" tone, with potential surprises in terms of scope and scale. Its main features compared to the September 2022 policy include:

(1) Increased support: The central bank’s relending quota has been raised from 200 billion yuan to 500 billion yuan;

(2) Financial institutions independently decide lending conditions: From financial institutions providing loans to enterprises at rates no higher than 3.2%, it has been relaxed to financial institutions independently deciding lending conditions.

From the perspective of policy effects, promoting equipment renewal and replacement is not only an important means to stabilize economic growth but also a key initiative aligned with the high-end, intelligent, and green development direction of the manufacturing industry. It is also significant for advancing new industrialization, building a modern industrial system, and accelerating the formation of new productive forces.

Driving Capital Expenditure, Potentially Reviving a New Round of Capacity Cycle

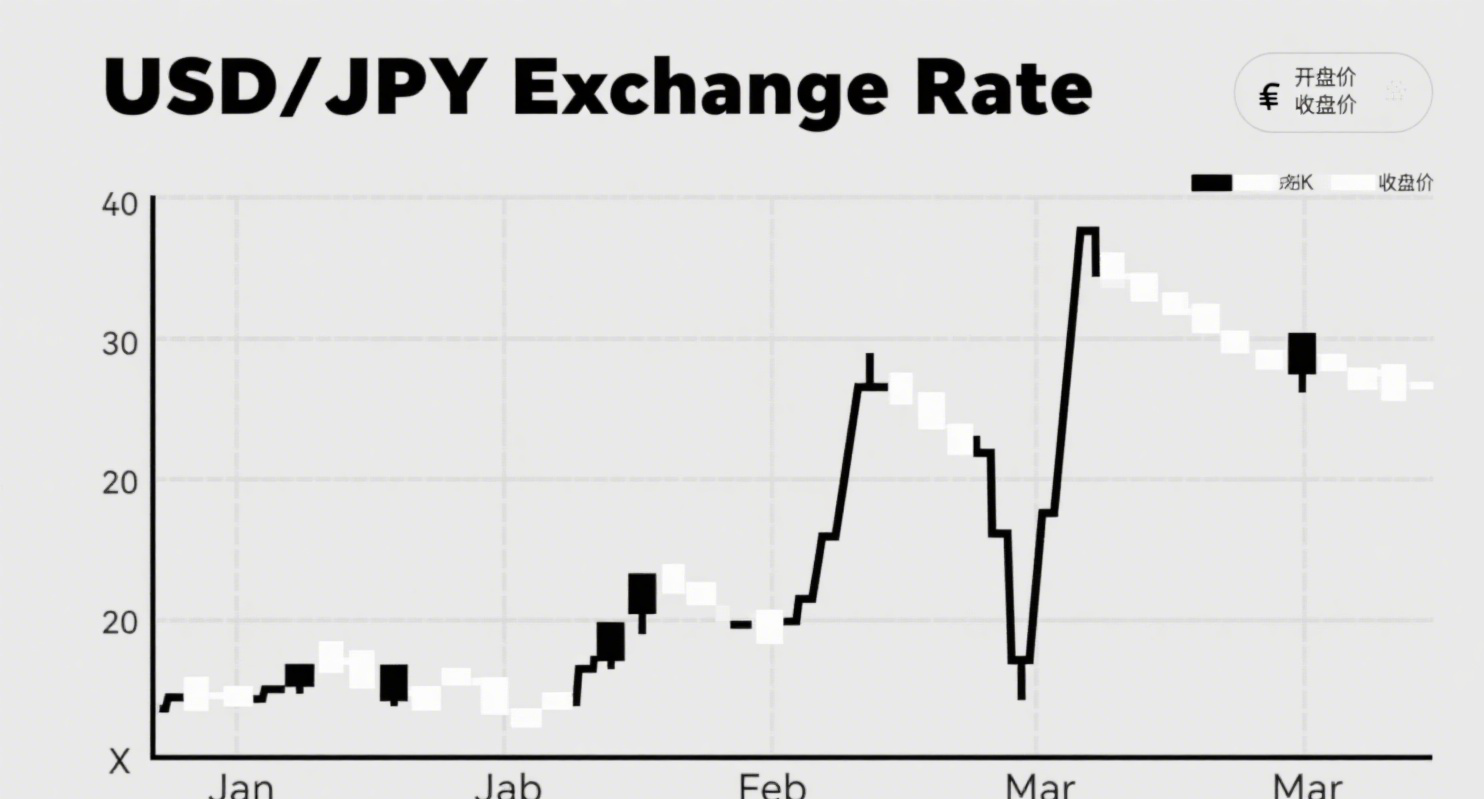

From the perspective of the capacity cycle, equipment replacement-driven changes in capital expenditure affect the economic cycle. Since the last capacity cycle in 2010, several shocks have been experienced, indicating that the supply-side market has undergone some clearing. In other words, the previous capacity cycle may be nearing its end, and a new cycle is expected to begin.

Against this backdrop, the equipment renewal and replacement policy could become a key driver for the revival of a new capacity cycle. According to the policy’s goal of "increasing equipment investment in industries such as industry, agriculture, construction, transportation, education, culture, tourism, and healthcare by more than 25% by 2027 compared to 2023," it is estimated that equipment investment from 2023 to 2027 could achieve an annualized compound growth rate of nearly 6% and an investment increase of over 300 billion yuan.

Benefiting A-Share Listed Manufacturing Companies

This round of equipment renewal and replacement policy will positively impact the profitability of A-share listed manufacturing companies. From different time dimensions, the policy may boost market demand and improve corporate profitability.

(1) Short to medium term: Facility renewal on the demand and supply sides will stimulate market demand, encourage inventory replenishment, shorten inventory cycle renewal time in the short term, address overcapacity issues, and increase corporate capital expenditure in the medium term, driving profit recovery through positive feedback.

(2) Long term: The policy’s implementation will directly increase corporate investment in equipment and technology, improving production efficiency, product quality, and technological levels, thereby enhancing profitability.

In summary, this round of equipment renewal and replacement policy will play a significant role in stabilizing economic growth and developing new productive forces. In the medium to long term, the value of A-share core assets is expected to rise through profit recovery and productivity improvements.