Several Commandments of Investment and Trading:

Avoid impatience: Do not act rashly without reasonable entry or exit conditions.

First Point: Generally, when you cannot discern the market direction—meaning the price is in a consolidation pattern—you should refer to weekly and monthly charts and try to enter positions along the trend-aligned boundary of the pattern. If the pattern breaks out in the trend’s direction, add to your position; if it breaks out against the trend, reverse your position. This approach is clear and easier to execute. Avoid trading both sides, as it will exhaust you, and when a real breakout occurs, you may hesitate to act.

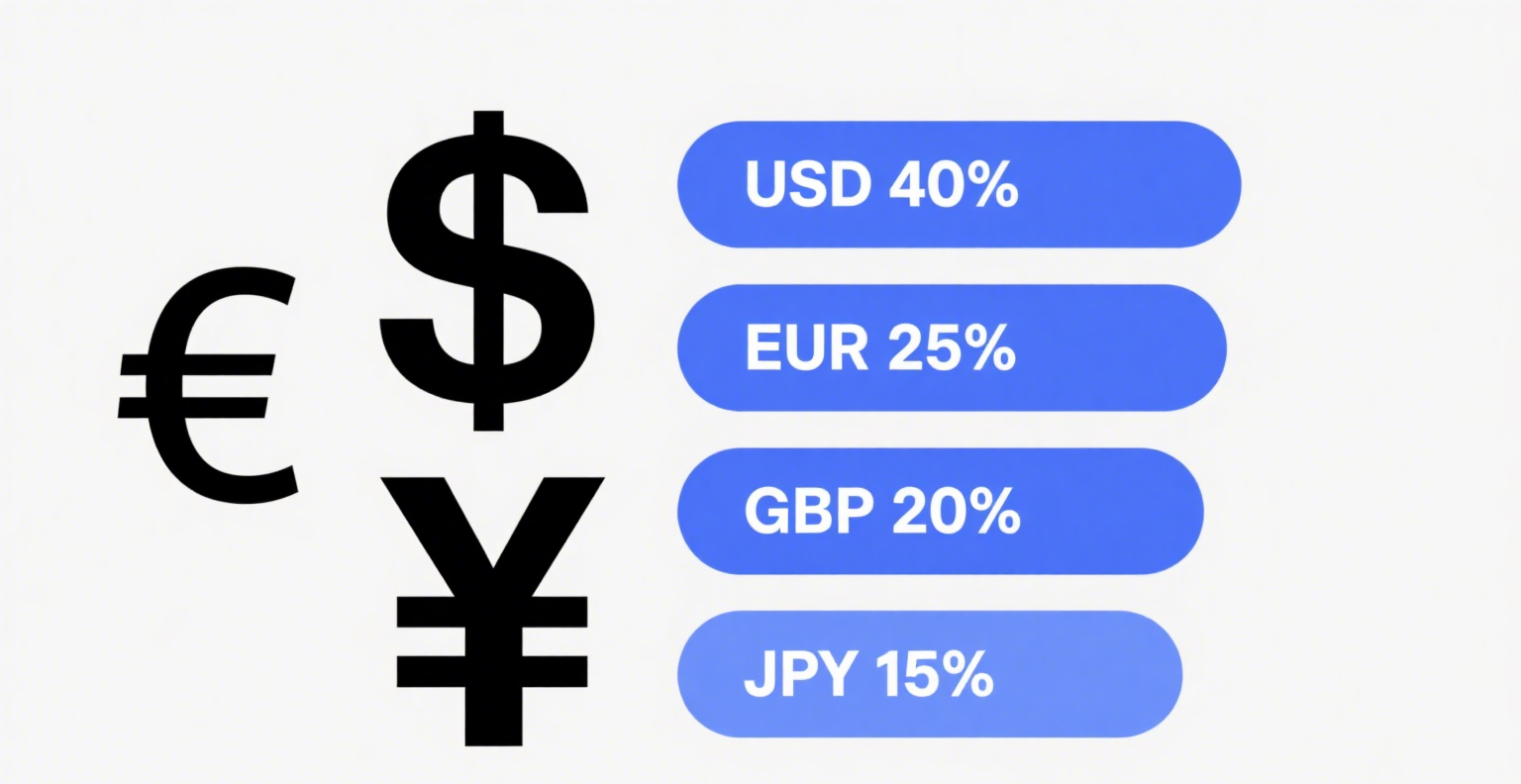

Second Point: Never hastily conclude that the trend has reversed. In other words, it’s better to stick with the original trend than to impulsively switch directions. True reversals are rare—they likely account for only about 20% of early trading opportunities, while the rest are trend-following opportunities. Why abandon high-probability opportunities to chase low-probability ones?

Third Point: A good mindset is not achieved overnight—it requires cultivation. This cultivation does not mean chanting sutras but rather practice—continuously refining your intuition through trading and summarizing both positive and negative experiences. This process takes at least two to three years. When your methodology becomes ingrained in your habits and personality, your mindset will naturally improve. If your mindset has not yet become second nature, if you still find yourself emphasizing its importance, then it’s certain that your mindset is still lacking.