Technical Analysis Theory Suggests:

First is the closing price principle. Generally, a breakout confirmed by the closing price is more reliable than a temporary intraday price spike.

Second is the percentage principle. It requires the closing price to exceed the reference price by at least 3% (though 3% is a general guideline—different assets may require different thresholds, but a minimum of 2% is essential).

Finally, the time principle. To confirm a valid breakout of a trendline, the market must close on the same side of the line for three consecutive days (though some argue two days are sufficient in futures markets).

While these principles are reliable, the confirmation process takes time, and by the time a breakout is confirmed, the market may have already moved significantly, raising entry costs for traders. Therefore, a more practical approach is learning to identify false breakouts ("fakeouts"). Based on my trading experience, here are key observations:

1. Divergence from the broader trend

When the overall market is in a correction, rebound, or consolidation phase, a high-volume breakout in an individual contract is more likely to be false. Conversely, during a clear market trend, breakouts aligned with the trend are more likely to be genuine. Traders should analyze fundamentals, historical capital flows, price levels, and institutional behavior. Be especially cautious of downward breakouts in low-price zones and upward breakouts in high-price zones.

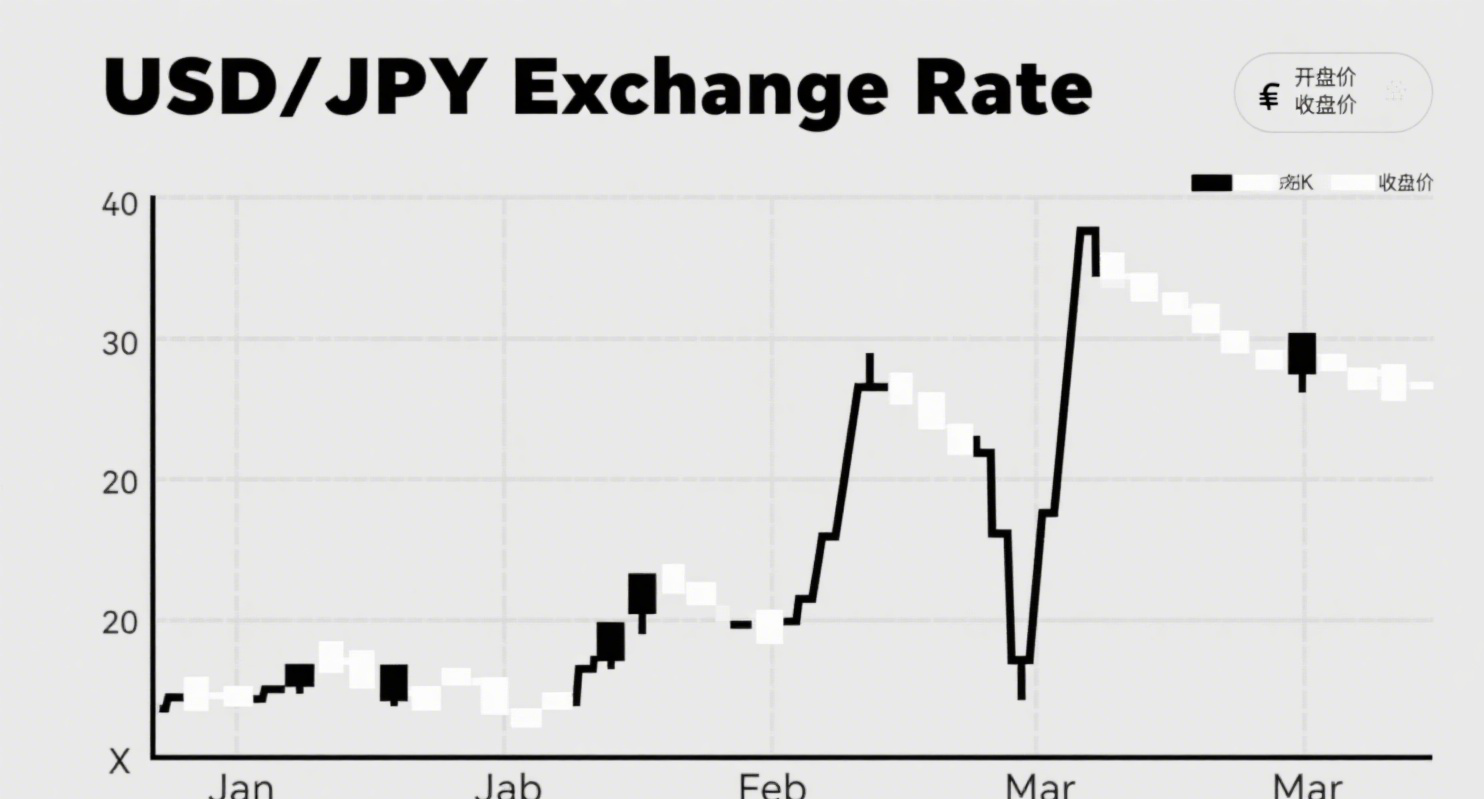

2. Volume divergence

In my experience, after a breakout, trading volume should increase in the direction of the trend—this is a critical clue to validate any price pattern. All completed patterns should be accompanied by a significant rise in volume, though volume is less crucial during early reversal stages or at pattern tops.