The Right Way to Approach Short-Term Swing Trading

Short-term trading refers to buying and selling within a relatively brief period to pursue quick profits. Short-term traders typically hold positions for a short duration, ranging from minutes to days. They focus on short-term market fluctuations and trends, aiming to profit from these movements.

The goal of short-term trading is to achieve small profits quickly. Traders may execute multiple trades to accumulate gains. They usually set stop-loss levels to control risk and take-profit targets to exit trades when a certain profit level is reached.

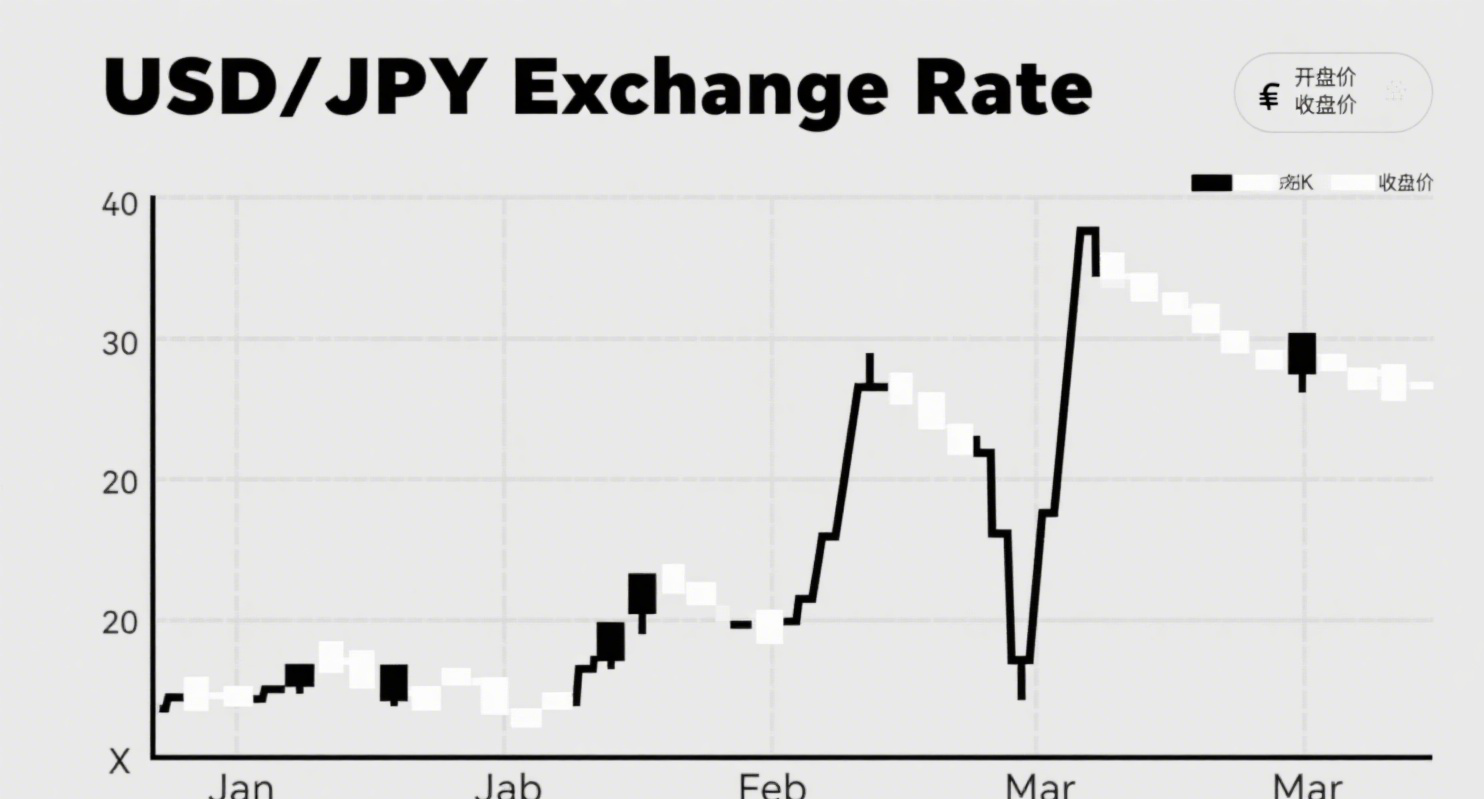

Short-term traders often use various technical analysis tools and indicators to analyze the market and develop strategies based on trends and volatility. They may rely on chart patterns, moving averages, the Relative Strength Index (RSI), and other technical indicators to identify market reversals and opportunities. They tend to focus more on short-term price movements and trading volume rather than long-term fundamental factors.

Short-term trading requires traders to make quick decisions, execute trades efficiently, and possess sharp market observation and prediction skills. This trading style carries higher risks and demands extensive experience and expertise.

After interacting with many investors, I’ve noticed a common phenomenon: many are particularly fond of short-term trading—the shorter, the better. They jump in and out of the market daily, finding it exhilarating. While some excel at it, most successful traders we see are actually medium- to long-term investors.

As a result, the belief that "short-term trading requires innate talent and is hard to master" has gained traction. However, people tend to be blindly overconfident—thinking, "There’s nothing wrong with short-term trading; if others fail, it’s their lack of skill, not mine." Thus, many stubbornly cling to short-term trading. While brokers and exchanges welcome the liquidity they provide, is this persistence truly justified for the traders themselves?

After talking with many short-term traders, I’ve identified two main reasons for their dedication:

1. Small Capital, Pursuit of Higher Returns

With large capital, even modest long-term returns can yield substantial absolute profits. However, short-term traders usually have smaller accounts, making long-term returns seem insignificant. They crave higher returns, which requires more frequent trading—ideally capturing every smooth price movement.

For example, a 1-minute intraday chart might occasionally show a streak of a dozen bullish candles, which looks irresistible. If they could consistently catch such moves, a 10x annual return wouldn’t seem impossible.

2. Efficiency and Instant Gratification

Short-term trading provides quick results, whether profitable or not. Unlike long-term trading, where positions are held for weeks with constant fluctuations, short-term trades settle rapidly. Floating losses make traders anxious to break even, while floating profits trigger fears of pullbacks—leading to sleepless nights. Short-term trading eliminates this stress by delivering immediate outcomes, aligning with the brain’s craving for instant gratification.

These reasons sound logical at first glance, but upon closer inspection, they don’t hold up.

The first reason is a classic case of "missing the forest for the trees."

Traders fixate on the smooth trends they hope to catch but often encounter choppy, unpredictable price action, leading to significant losses.

There’s a story about a man who lost his ring while walking at night. When he retraced his steps to search, an onlooker noticed he was only looking under streetlights and asked, "Why not search the dark areas?" The man replied, "How can I find it where there’s no light?" He forgot his real goal was the ring, not the act of searching.

Similarly, short-term traders obsessed with smooth trends are like the man under the streetlight—the "smooth" parts are rare, while most of the market remains unpredictable. To succeed, they must adapt to the entire market, not just the ideal conditions.

The second reason relates to delayed gratification.

In a famous psychology experiment, children were given candy and told: "Eat one now, or wait 20 minutes and get two." Some couldn’t resist and ate it immediately, while others waited for the bigger reward. Follow-up studies showed that those who waited tended to achieve greater academic and career success.

For a child, resisting the urge to eat candy is agonizing—just like enduring the stress of holding a position. But what we truly want is the two candies, not just one.