During the period from 2011 to 2014, blockchain technology entered China, and the mining industry began to gradually rise domestically. Meanwhile, the blockchain industry abroad was also continuously developing, but it took a different path—digital currency.

Rewinding to 2011, this was the year when Satoshi Nakamoto completely disappeared from the blockchain world, and the development authority of Bitcoin fell to his successor at the time—Gavin Andresen. The first thing Gavin Andresen did after taking over was to decentralize Bitcoin’s management authority among other members of the core development team, Core, marking the beginning of Bitcoin’s fully decentralized era.

Not long after this, on September 27, 2012, the Bitcoin Foundation was officially established to standardize, protect, and promote the healthy development of Bitcoin. This foundation later played a significant role in Bitcoin’s compliance and community growth.

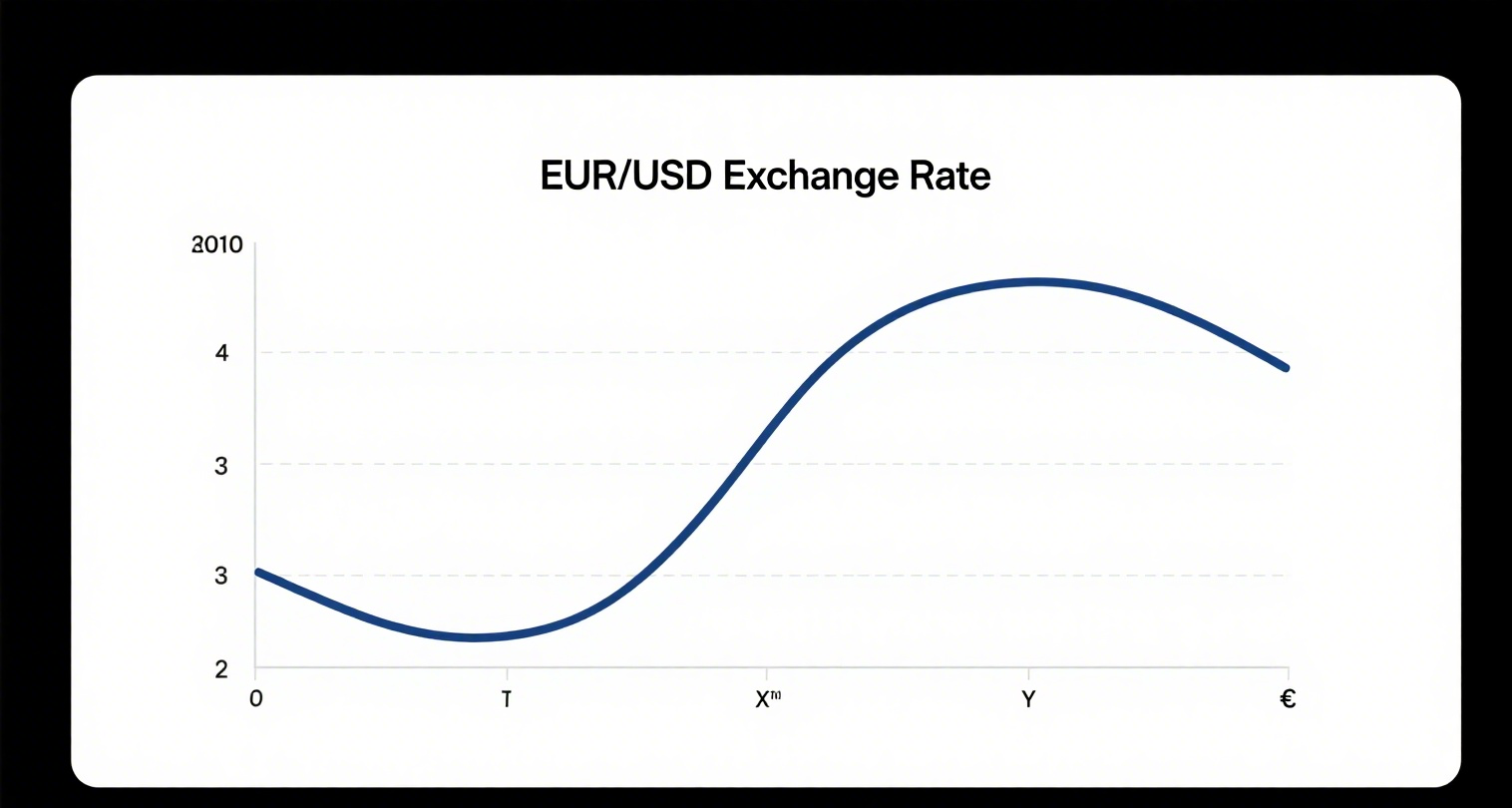

Then, on November 28, 2012, Bitcoin experienced its first halving event, where the mining reward was reduced from "50 BTC per 10 minutes to 25 BTC." This marked the beginning of Bitcoin’s first historical peak.

In the following period, Bitcoin’s price began to soar rapidly. Although there were occasional negative incidents, such as exchange hacks and private key leaks, these did not hinder Bitcoin’s continued upward trend.

Finally, on November 29, 2013, Bitcoin’s price peaked, surpassing gold for the first time at an astonishing $1,242 per BTC, while gold was priced at only $1,241.98 per ounce at the same time. Due to Bitcoin’s rapid development, the outside world began to pay intense attention to it, and more tech leaders and capital gradually started researching the blockchain technology behind Bitcoin.

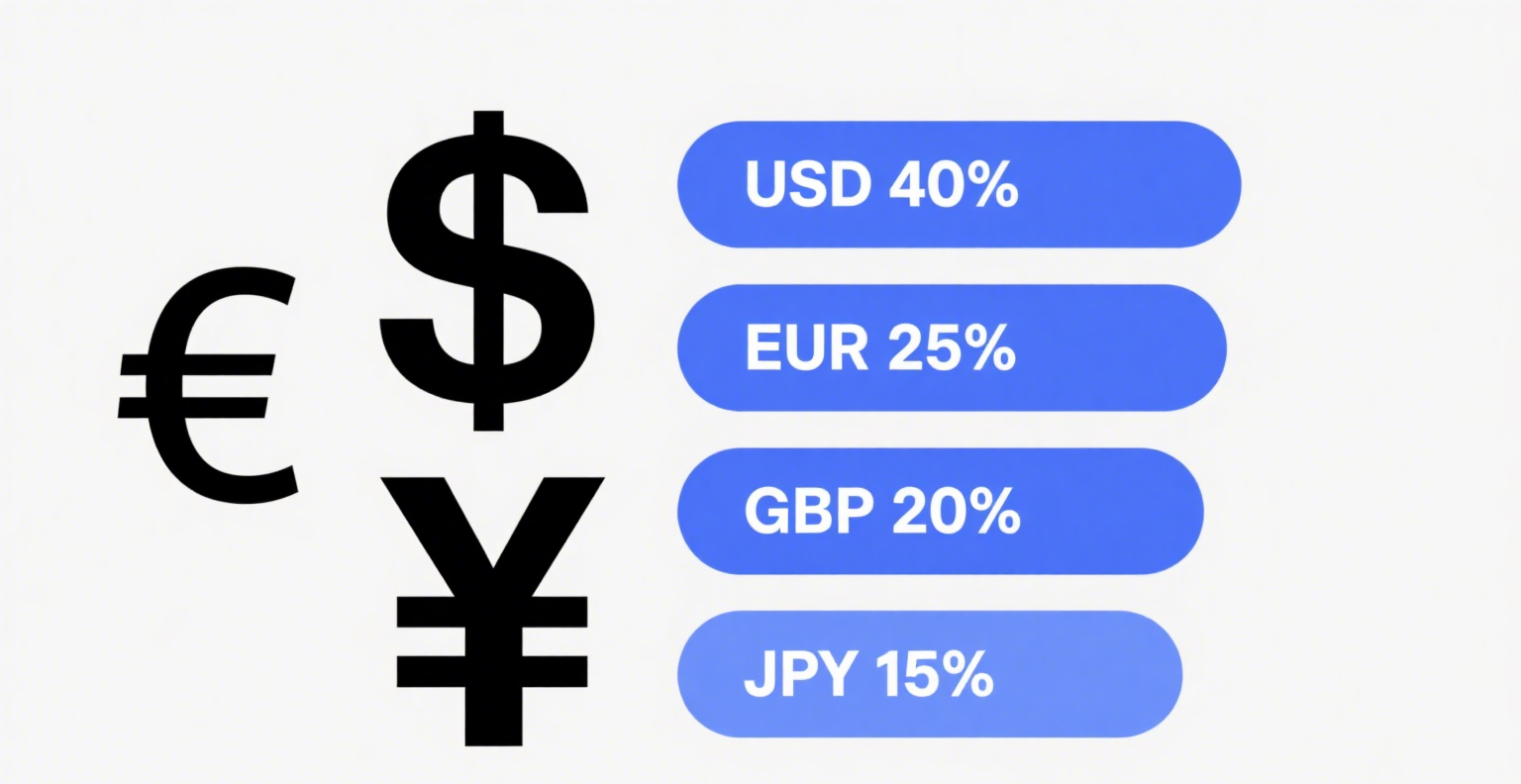

Many bet on the digital currency payment track. Unfortunately, during this period, apart from a few innovative projects, most simply copied Bitcoin’s concept, tweaked some code, and released their own versions—creating digital currencies for the sake of digital currencies. This led to a flood of山寨 (copycat) projects in the market.

However, their dominance was short-lived. On December 5, 2013, the People’s Bank of China and four other ministries issued the "Notice on Preventing Bitcoin Risks," clarifying that Bitcoin does not have the same legal status as currency and cannot be used as a circulating currency in the market. On the day of the announcement, Bitcoin’s price plummeted, entering its first major bear market. Over time, those山寨 projects with no practical value faded into obscurity, while Bitcoin solidified its role as "digital gold."

In summary, during the 2012-2014 period, the global blockchain community seemed trapped in a mindset that blockchain technology could only be applied to digital currencies. It wasn’t until the emergence of a young prodigy in 2014 that this limitation was broken—this prodigy was the now-renowned Vitalik Buterin (V神). With his Ethereum, Vitalik would go on to unleash a true blockchain revolution, ushering in a wave of public chain technology.