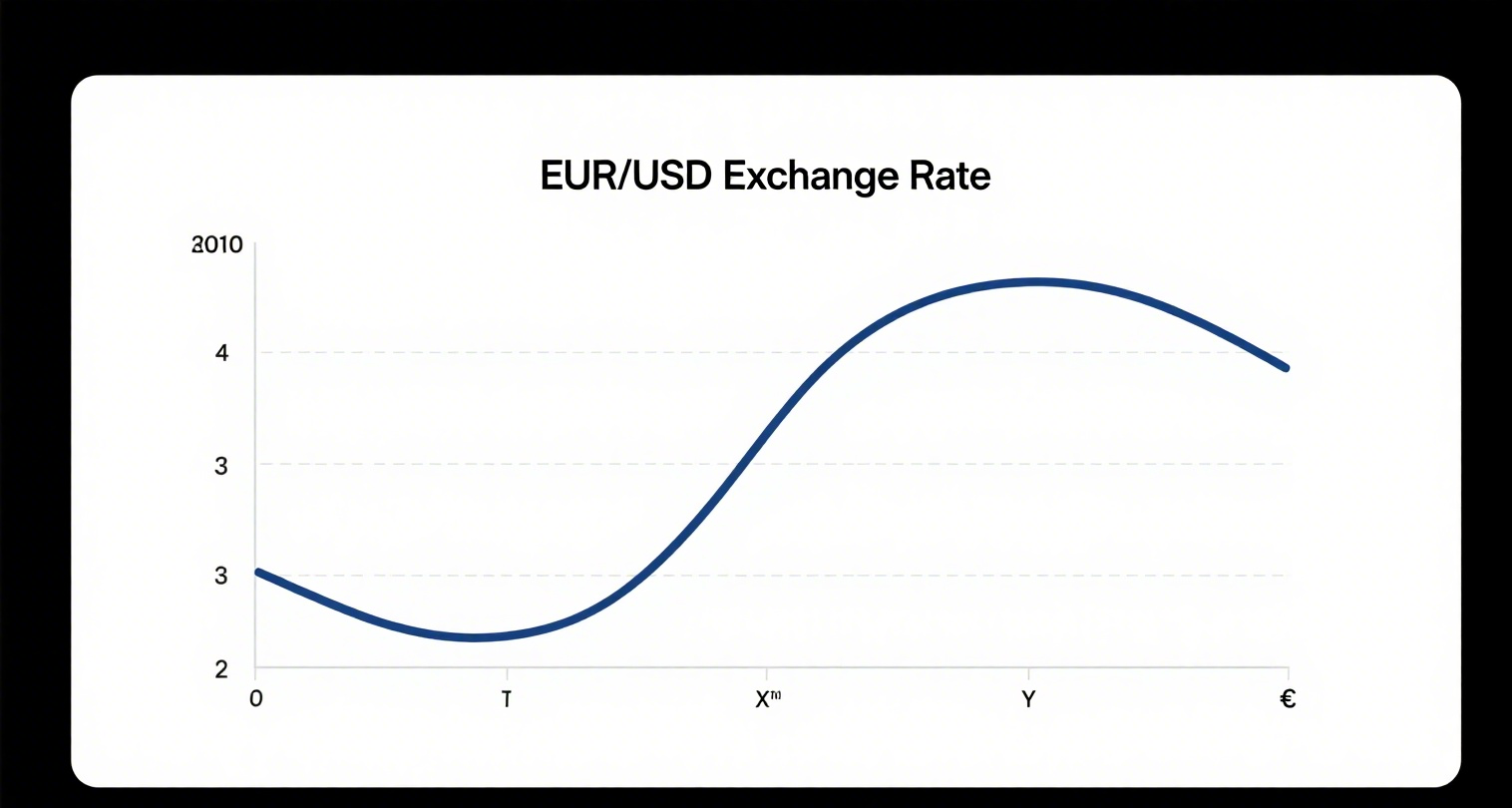

Depending on market price movements, free trading can be divided into trend trading and range trading. Trades generated during one-sided upward or downward trends are considered trend trading, while trades occurring within a certain price range with continuous fluctuations are range trading. Different trading strategies apply to different scenarios. Below are several examples for investors to learn and reference.

-

Trend Trading Strategies

① Trend-Following Strategy

A trend-following strategy involves trading in the direction of a trend once it is confirmed or about to be confirmed. For example, buying (going long) in an upward trend and selling (going short) in a downward trend. This strategy is also known as "buying high and selling low." However, trend-following is not merely about chasing rallies or selling declines. Instead, it requires a rational assessment of the current market trend, using a combination of indicators such as candlestick patterns and moving averages across different timeframes to identify better entry points for trend-following trades. For short-term, long-term, or swing trading, traders need to refer to data indicators and candlestick patterns across various timeframes. Moreover, for aggressive, stable, or risk-averse traders, there are different entry opportunities even within the same timeframe, requiring them to choose and execute their investment plans based on their actual situation and needs. While trading with the trend, one must also remain vigilant against sudden trend reversals.

② Counter-Trend Strategy

On one hand, counter-trend trading involves taking positions against the prevailing trend when it weakens—for example, shorting when an upward trend loses momentum or buying when a downward trend weakens. On the other hand, counter-trend trading also includes buying or selling against the trend to "buy the dip" or "sell the top." Selling when an upward trend weakens is called "exiting the top," while buying when a downward trend weakens is called "bottom-fishing." By gauging the strength of bullish and bearish forces, traders can assess trend momentum and execute counter-trend trades accordingly. However, counter-trend trading carries significant risks, requiring advanced technical skills and strict risk management, including proper stop-loss and take-profit settings.

-

Range Trading Strategies

① Pattern-Focused Trading

Range-bound markets are characterized by unclear bullish or bearish signals, with prices fluctuating within a certain range. Although speculative opportunities are limited in such markets, range-bound conditions dominate most trading periods, leading to the development of various strategies tailored for these conditions. With proper capital management and strict system adherence, profits can still be achieved in range-bound markets. In such scenarios, a well-structured trading system is essential, with a focus on pattern-based indicators. Available strategies include high-leverage short-term trading, low-leverage swing trading, unleveraged spot trading, or even holding spot positions and waiting for opportunities.

② Breakout Strategy

Range-bound markets also have key levels where trend-following strategies like "buying high and selling low" are ineffective and may lead to significant losses. However, during critical moments when a range-bound market transitions into a trend, traders can capitalize on breakout signals, such as surpassing previous highs or consecutive bullish daily candlesticks, to enter trades and wait for the trend to fully develop into a one-sided movement. In breakout strategies, setting stop-losses is crucial, as incorrect signals without proper stop-losses can result in substantial losses.