Is It Good or Bad for a Stock to Appear on the Dragon and Tiger List? How to Use the List?

The Dragon and Tiger List data is closely watched by many investors and is even used as a reference for stock selection. But is it good or bad for a stock to appear on this list?

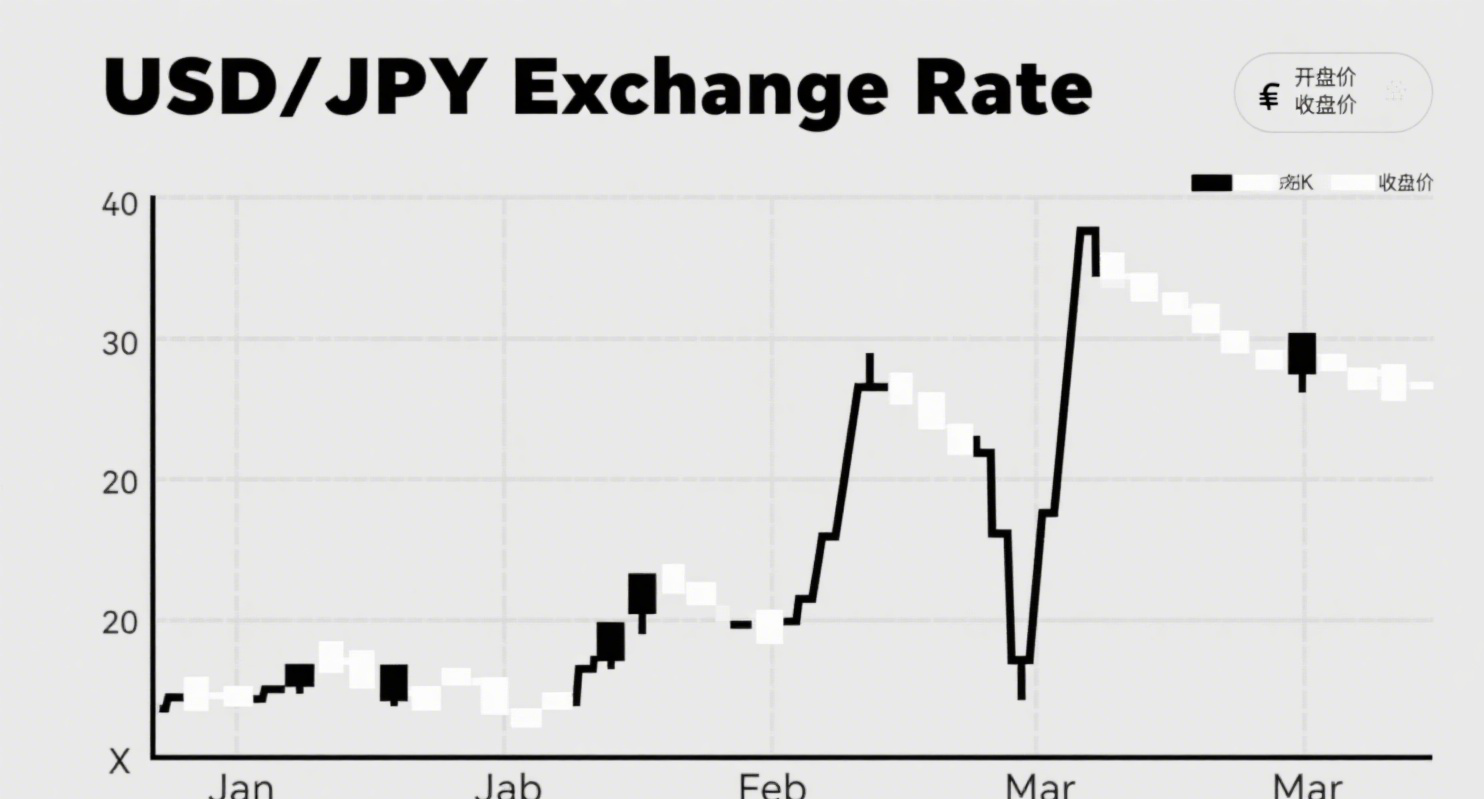

The list is usually updated by the exchange between 4:30 PM and 5:10 PM after the market closes and can be viewed on financial websites. It ranks stocks based on daily price changes and turnover rates, helping investors identify securities firms with high trading volumes and analyze capital flows in volatile stocks—whether driven by hot money or institutional investors.

A stock may appear on the Dragon and Tiger List for the following reasons:

-

Daily price deviation reaches 7%

-

Daily turnover rate hits 20%

-

Daily price amplitude reaches 15%

-

Cumulative price deviation over three consecutive trading days reaches 20%

The list selects the top three stocks meeting each criterion. In the Shenzhen market, the top three from the Main Board, SME Board, and ChiNext Board are listed, along with their top five trading seats.

Investors can check the list for daily, quarterly, or yearly data to identify top-performing stocks. However, appearing on the list does not necessarily predict the next day’s performance—it is neither purely bullish nor bearish. Generally, it is considered positive, but major players might use the data for contrarian strategies. Therefore, investors should not rely solely on this list but also consider stock price levels and other indicators for a comprehensive analysis.