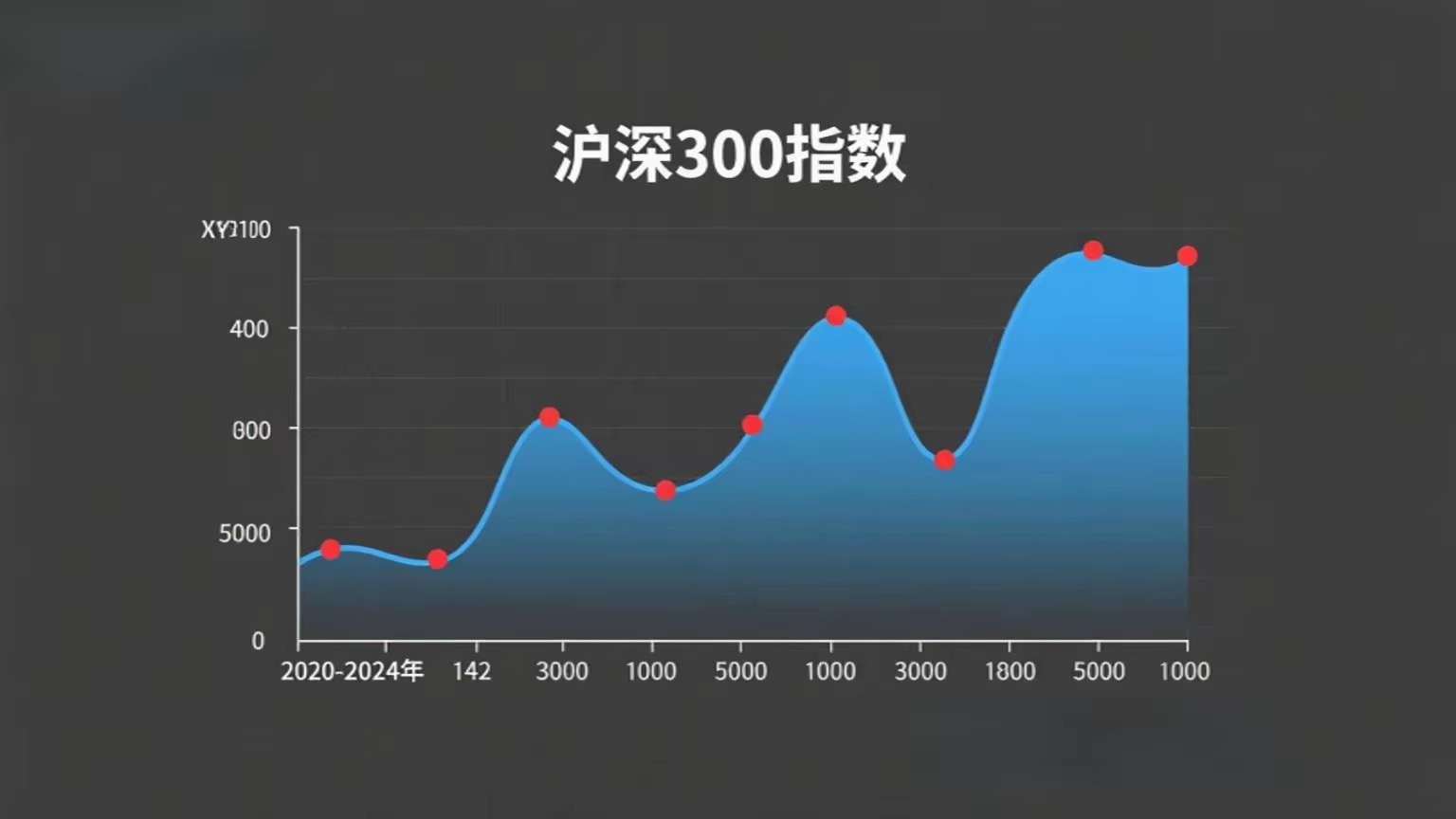

With the improvement in living standards, people now have some idle funds for investment. The variety of investment options has become more diverse, and even high-risk investments like stock index futures are now accessible to individual investors. Although stock index futures are high-risk, they also offer high returns, which appeals to aggressive investors, leading to increased enthusiasm for participation. Recently, some have inquired about the requirements for opening a stock index futures account and how it differs from stocks. Here’s the explanation.

Requirements for Opening an Account

What are the requirements for opening a stock index futures account? First, you need to provide a copy or scanned version of your bank card, and ensure both the front and back of your ID card are scanned or copied. Second, you must prepare relevant photos, including a front-facing photo for signing the contract. The photo should have a resolution of at least 5 megapixels and primarily feature a half-body shot. Once these materials are ready, you can proceed to a futures company to complete the process.

What is the Account Opening Process?

What are the steps for opening a stock index futures account? First, the client must submit the necessary documents and proof materials to the futures company for review. Second, the futures company will provide the client with a "Risk Disclosure Statement" and "Futures Trading Rules," emphasizing the risks of futures trading. If the client agrees, they must sign these documents, and the fees (such as commissions) will be confirmed. Third, the client will sign a contract with the futures company, clarifying the rights and obligations of both parties. After these steps, the account opening process is complete.

How is it Different from Stocks?

Now that you understand the account opening process for stock index futures, how do they differ from stocks? First, stock index futures have an expiration date and must be traded before maturity; they cannot be held indefinitely. In contrast, stocks have no time limit, and investors can sell them whenever they deem appropriate. Second, stock index futures are traded on margin and settled daily based on price fluctuations. This trading method involves leverage, which inherently increases investment risk. Third, stock index futures allow short selling, making long and short positions more flexible. The variety of trading methods makes the strategies more complex, demanding higher skills from investors. Fourth, stock index futures use cash settlement and are based on the stock market, but only profits and losses are exchanged—no physical assets are transferred. Lastly, futures trading has higher liquidity, with daily trading volumes often exceeding those of the stock market.